CFD Trading Instrument for FX Brokers With Full Market Control

A gamified, high-load SaaS platform that enables FX brokers to trade currencies and commodities with full market control. Built for high-frequency trading, it delivers ultra-fast, low-latency order execution and a real-time bidding process. A vector-based trading engine analyzes market data and forecasts trends, while a complete reporting suite ensures full financial health oversight.

Technical stack includes:

- Backend: Java, Spring Boot, VertX, Hibernate, Spark

- Frontend: ReactJS, AngularJS, Web Sockets

- Databases & Caching: Cassandra, PostgreSQL, Redis

- Infrastructure: AWS, Amazon S3, Kubernetes, Docker, Jenkins, GitHub, DockerHub

- Monitoring & Analytics: Zabbix, Grafana

The task

We were asked to build a mobile-ready options and CFD trading platform with a gamified approach to short-term trading. Designed as a B2B SaaS, it gave brokers a powerful tool to offer their traders. The platform has already been tested and validated with several FX brokers in the UK.

The team

All funding was secured, so the client needed us to launch fast. Within one month, we assembled 14 engineers dedicated to the project. The team was fully self-sufficient, handling everything from requirement analysis and system design to delivery and ongoing support.

Pivots

The product went through several key pivots in search of a sustainable model. We helped plan and implement each: shifting from B2B to B2C, redesigning trading tools and UX three times, experimenting with payment flows, and finally moving the focus from the EU to China, facing new challenges along the way.

Support & evolution

We have supported this platform since 2015, through pauses and investor transitions. Each time the project was revived, we adapted it to new markets and needs. With new funding in 2018, we tailored it for China, added features, and guided it through a complex post-MVP stage.

Reactive and Low Latency Application

Stay ahead of the market with a platform built for speed and responsiveness.

- Reactive and low-latency application design

- Historical data graph tracking instant asset price changes

- Prices updated every 0.4 ms in real time

- Integrated with up to 50 asset price feeds

- Powered by Big Data storage for analytics on massive datasets

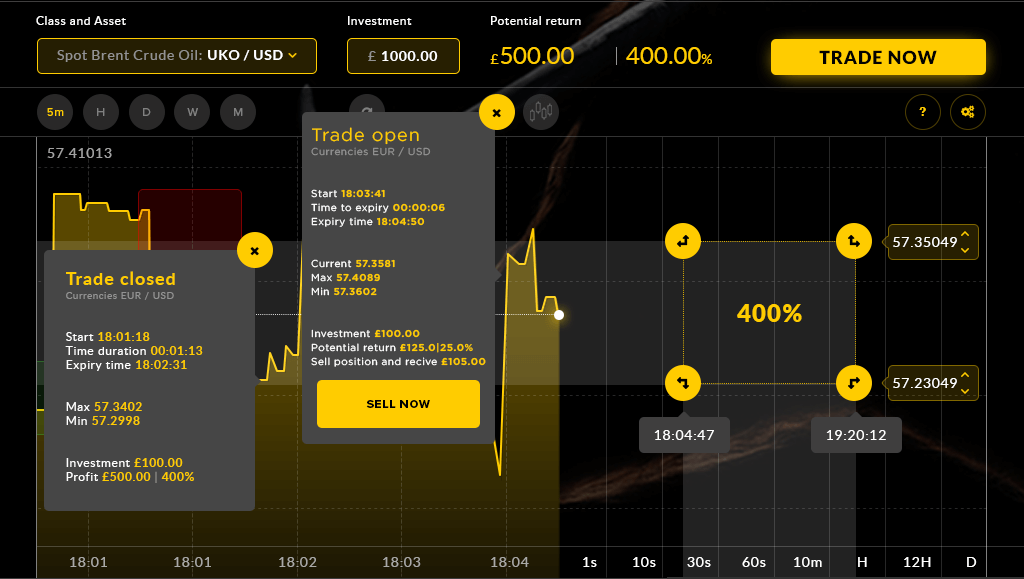

Intelligent Trading Mechanism

Execute trades in milliseconds with a secure and transparent process.

- Real-time bidding organized within the platform

- Transactions executed at 0.1 ms

- Reactive framework with web sockets for fast and safe data sharing

- Forecasting based on advanced vector algorithms

- Automated bet verification and payout processing

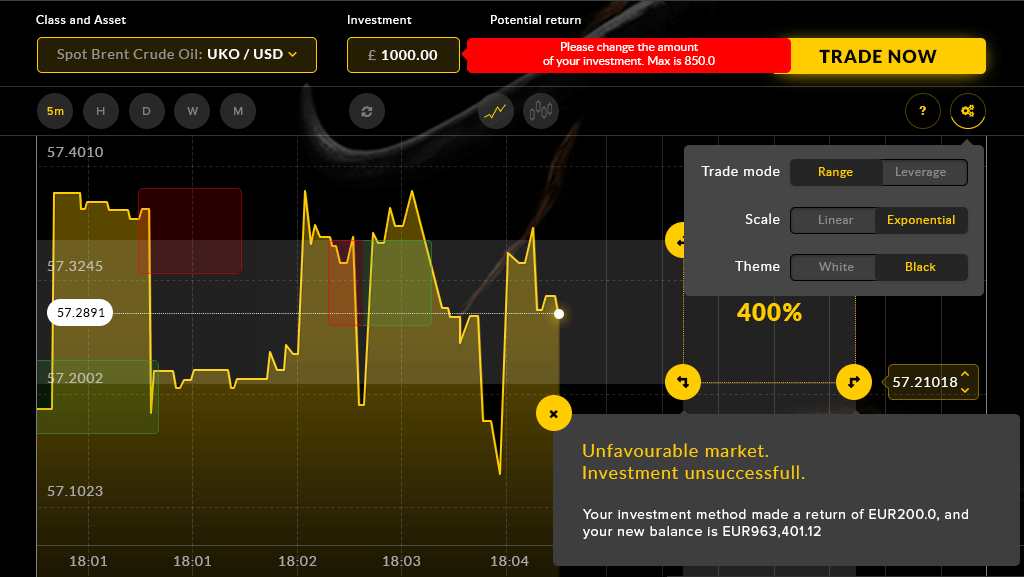

Personal Trading Configuration

Give traders full control with a tailored trading environment.

- Custom asset class and asset type selection

- Only live, tradable assets displayed

- Access to Currencies, Indices, Commodities, and Sentiments

- Full coverage of global currency exchange rates

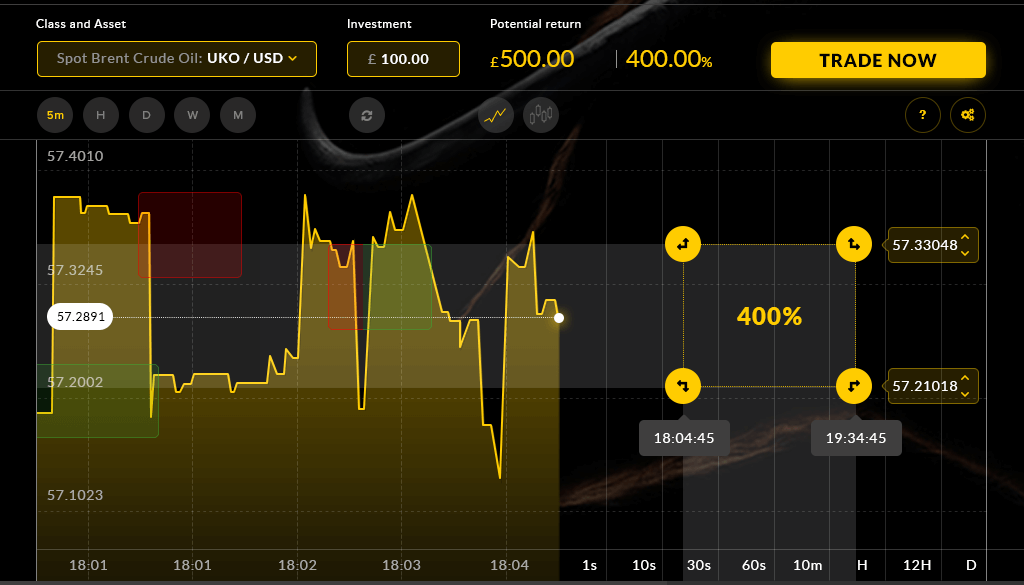

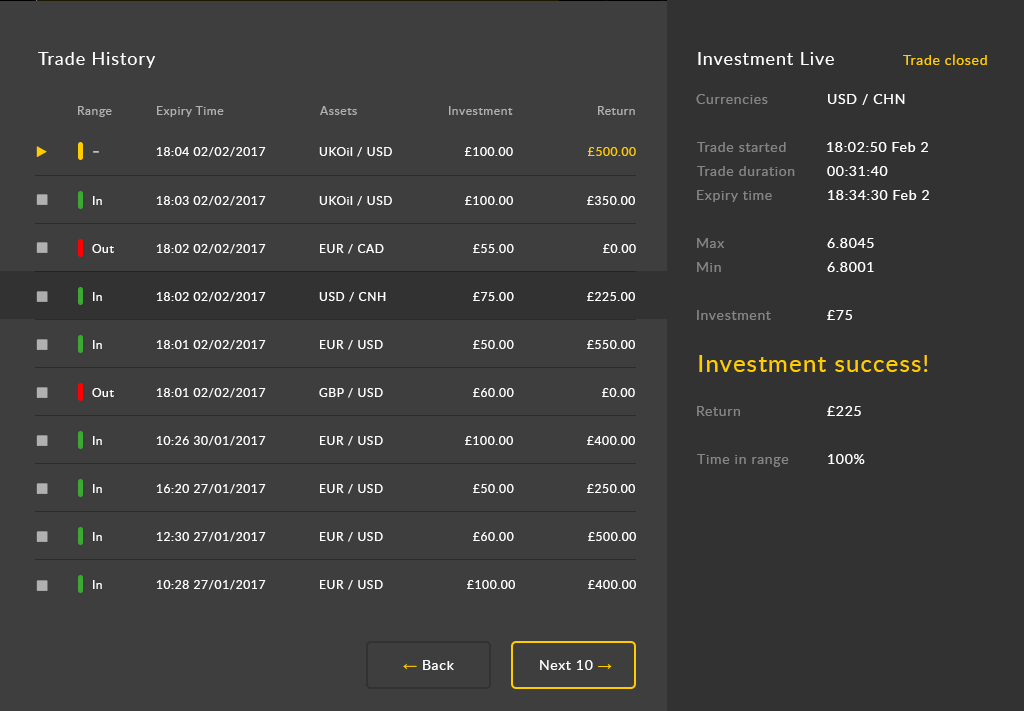

Open Positions Opportunities

- Live trades visible in the Open Positions window

- Detailed trade history always accessible

- Investment Live window shows both active and past trades

- Option to exit trades early for risk management

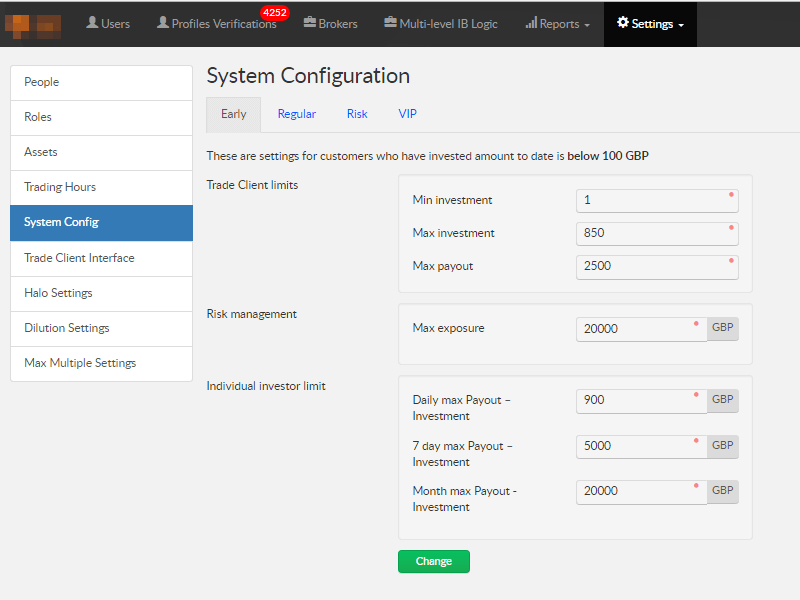

Adminisrtation Interface

The administration UI developed with ReactJS allows review and edit of all registered clients, review balances and rates of all clients, manage and create brokers, customize broker's service settings, branding, configuration, etc.

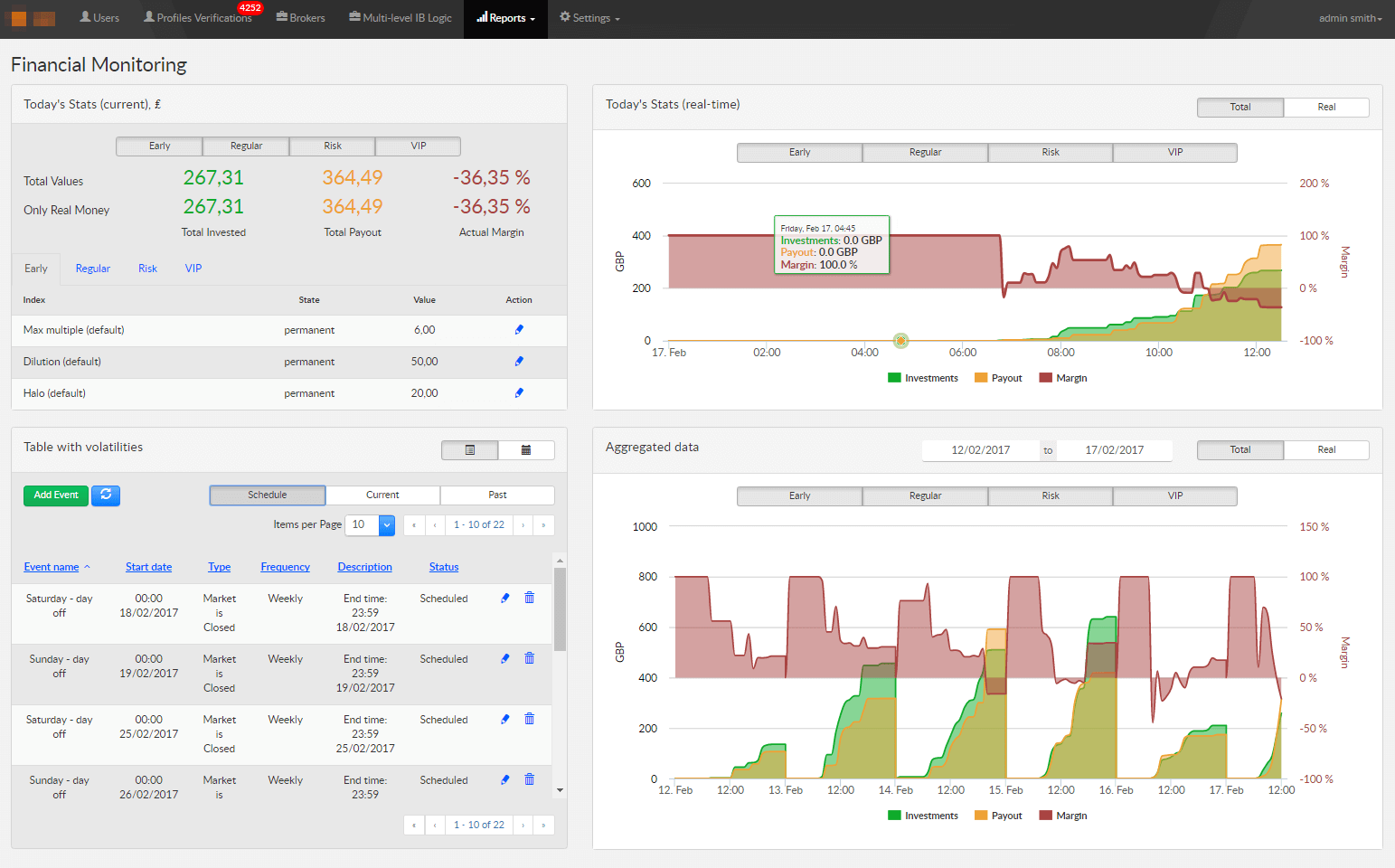

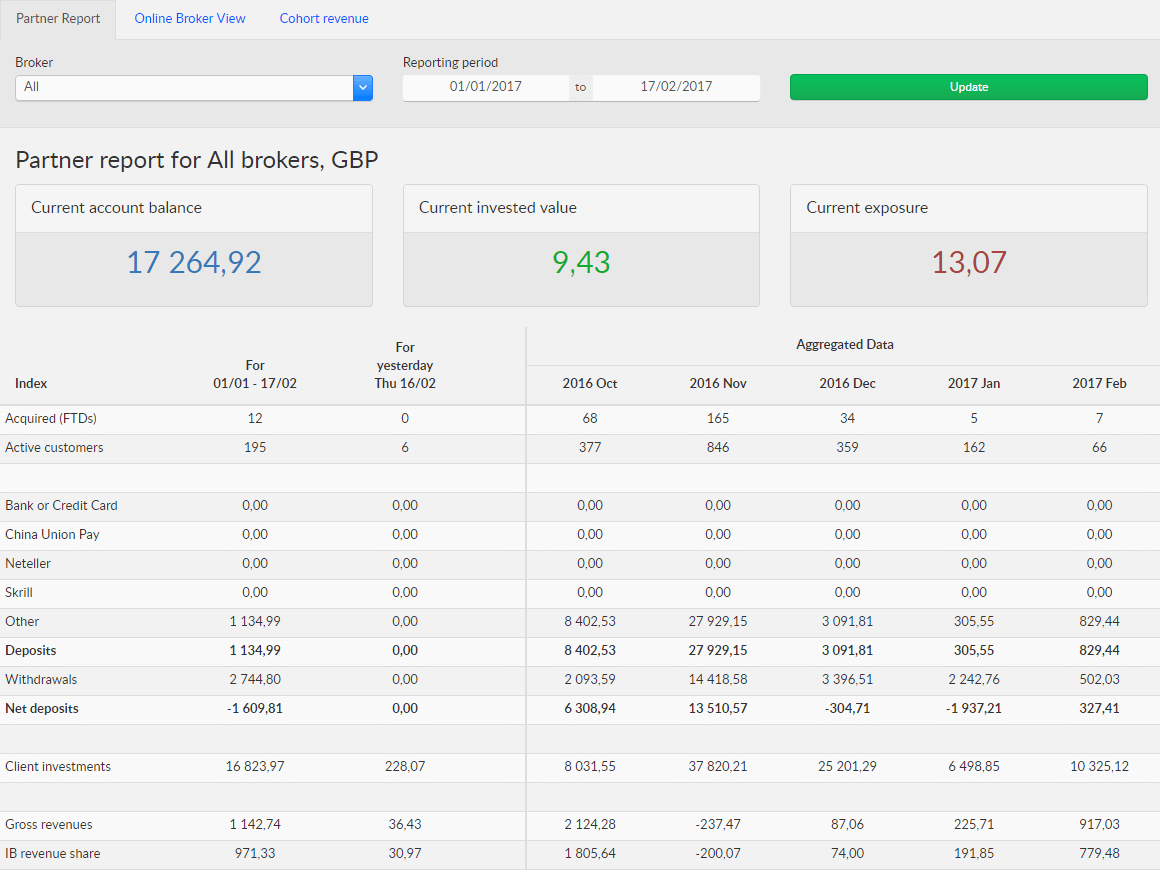

Reporting we developed to maintain the market

- Cohort analysis

- Marketing support

- Financial Monitoring

- Risk management

- Trade Management settings - minimum and maximum amount of investment, market availability time, etc.

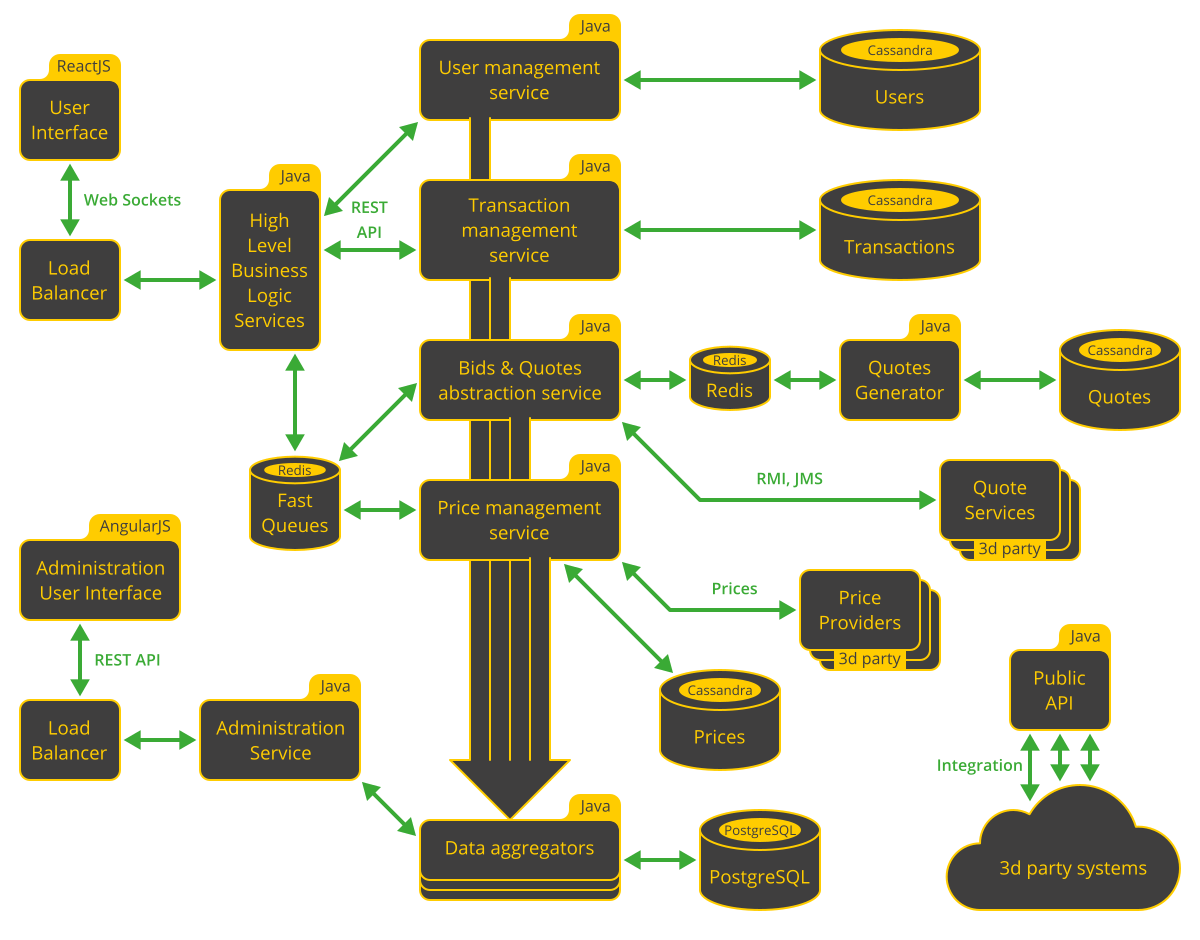

Server Architecture

A future-proof backbone designed to handle enterprise demands.

- Microservices-based architecture with 7 independent services

- High-throughput data flow from 3rd-party price providers

- Ultra-fast order execution engine

- Open APIs for external system integrations

- Capable of serving multiple FX brokers simultaneously

Customer feedback

"I reached Ardas because they had experience in developing Saas products and at the same time understanding the fintech industry, in particular forex trading and the work of brokers. It was a remarkable coincidence.

They made an MVP within five months. It was a product that I showed to investors, and it inspired them. Thanks to this, I closed several rounds of investments. Then we made a product that meets all the standards of the trading world in terms of security and the speed of updating information and executing transactions.

Initially, the system was planned as binary options trading, but due to the fact that in 2017-2018 it was banned in many countries, we have reformed the product into CFD trading.

Ardas proved to be very flexible in this situation - they discussed our new goals and vision. They built a plan and implemented it in a few months. During all this time, we did not feel any technical difficulties. They did everything themselves, and we only had to approve the priorities.

Another big technical challenge we had was entering the Chinese market. That included a transition to Alibaba servers, Chinese payment systems, support for several languages.

There were many technical hurdles with this, and few people have experience with Chinese infrastructure. Still, Ardas figured it out and ensured us the smooth operation of our product in China."

Get Insights from Real SaaS Builds

Enjoyed the read? We write these case studies and articles to share what works — and what doesn’t — in real SaaS delivery. Got a challenge of your own? Let’s talk tech.

Ryzhokhin