fintech Challenges We Solve

Data & Security Breaches

The risks and complexity of fintech systems keep rising, with cybercrime making financial platforms more vulnerable and attractive to attackers.

Regulatory

and Compliance Laws

Strict compliance is now one of the biggest challenges in fintech, with global regulations expanding and requirements becoming harder to manage.

Lack

of Tech Talents

Building enterprise-grade products demands access to rare expertise—specialists with deep technical skills and proven experience in fintech.

Continuous

Innovation

Shifting customer expectations force companies to adapt fast, modernize systems, and innovate constantly to stay ahead of competition.

FinTech Domain Expertise

Our expertise goes far beyond listed services, and we’ll gladly share it with you. If you don’t see the solution you need, reach out. We’ll explore your case together and find the right approach.

Success Stories

Why Choose Ardas

Transparency

We ensure every hour adds value. All work is tracked and reported, so you always know where your investment goes.

Estimation Accuracy

Our estimates are precise, enabling predictable delivery and ensuring projects are completed on time.

Process Expertise

With over 20 years of refining SDLC practices, our team delivers reliability, scalability, and consistent quality across industries.

Cloud Expertise for Fintech

From lightweight apps to complex fintech platforms, our cloud-native solutions ensure security, compliance, and scalability.

Budget in Control

We guarantee no hidden costs. Every stage is planned and reported, keeping your budget fully under control.

Fast Scaling

We streamline delivery by removing inefficiencies, accelerating time-to-market, and enabling rapid product growth.

FinTech Software Development Process

Our Financial Software

Solutions

Recognitions

and Partnerships

FAQ

How To Build A Fintech Software?

Start with the problem, not the code. Identify your customers’ financial pain points and solve them with a focused solution that outperforms competitors. Because fintech is a highly regulated industry, success also requires deep knowledge of compliance frameworks (GDPR, PCI DSS, PSD2, AML/KYC) and how they apply to your product. Partnering with a team experienced in fintech regulations helps you avoid costly mistakes and accelerate time to market.

Is Fintech Software Development Outsourcing A Good Idea?

Yes, if you do it strategically. Hiring fintech developers in the U.S. or Western Europe can be expensive and time-consuming. Outsourcing to proven teams in cost-effective regions like Eastern Europe allows you to:

- Access fintech engineers with domain expertise

- Scale your team quickly without heavy overhead

- Optimize costs while keeping enterprise-level quality

- Outsourcing also reduces risks of talent gaps while giving you flexibility as your platform grows.

What Technologies Are Used In Fintech Development?

Modern fintech platforms rely on custom-built solutions, not off-the-shelf software. Common technologies include:

- Languages: Python, Java, JavaScript, C/C++

- Databases: PostgreSQL, MongoDB, Redis

- Cloud & Infrastructure: AWS, Azure, Kubernetes, Docker

- AI & Data: Machine learning models, fraud detection tools, data pipelines

- Security: Encryption libraries, identity management, and secure APIs

The exact stack depends on your product vision, scalability needs, and compliance requirements.

How Do You Make A Highly Secure And Compliant Financial Platform?

Security and compliance must be embedded from day one. Best practices include:

- Following ISO/IEC 27001 and SOC 2 for information security

- Ensuring GDPR, PCI DSS, PSD2, and AML/KYC compliance

- Using end-to-end encryption, tokenization, and multi-factor authentication

- Building with DevSecOps practices for continuous monitoring and risk mitigation

This ensures customer trust, reduces regulatory risk, and keeps your fintech app enterprise-ready.

How Does Fintech Impact On Banks?

Fintech startups and digital-first banks are forcing traditional institutions to modernize. Banks are adopting AI, mobile-first apps, and real-time payments to compete with fintech solutions that offer speed, transparency, and lower costs.

Instead of being replaced, many banks now partner with fintech providers to deliver digital services faster while staying compliant.

Build FinTech Software Designed for Performance and Security

We architect scalable systems with real-time data processing, API integrations, automated financial operations, and antifraud solutions. Leave a request, and our team will get back to you within 1 business day.

Clients Say About Us

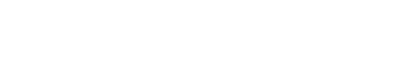

Dmitry Kulaksyz

‘’Great job’’

We started in 2016 with an idea and built a very detailed MVP plan mostly thinking about how to compete in a very busy market. We investigated all disadvantages of existing builders and designed a WYSIWYG builder that saves 50% more time than others. Later in 2019 we supported AMP language by Google for dynamic emails and became one of a few builders with the best AMP support.

Project Dates 2017 - Present

Project Summary

This startup became №1 in the world used by Amazon, McDonald's, Oracle, CocaCola, Airbnb, Uber, HP, and Cisco.

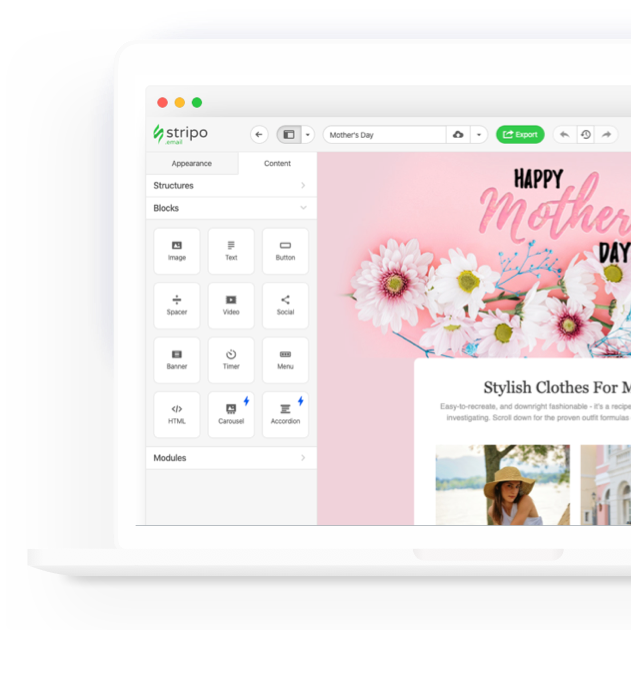

Read CaseAlex Mladenovich

‘’Removed Problems From Us’’

Ardas was tasked with the re-development of our mature SaaS application. They initially helped us with our new hosting architecture before working with us to re-design and develop all elements of the application.

Project Dates 2007 - Present

Project Summary

Today we are proud to be a part of the highly technical and very successful SaaS solution. Building long-lasting relations is never easy, we have been accurate with all the details through the years.

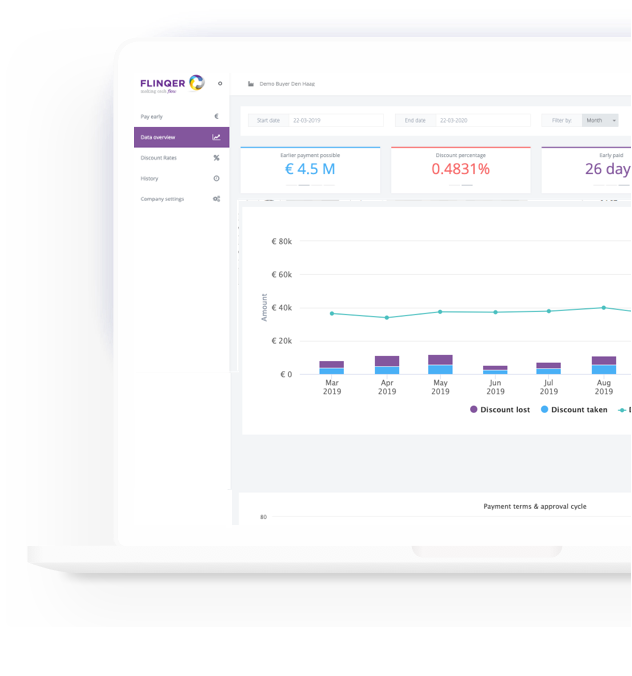

Read CaseMichael O'Sullivan

‘’Ardas is very flexible’’

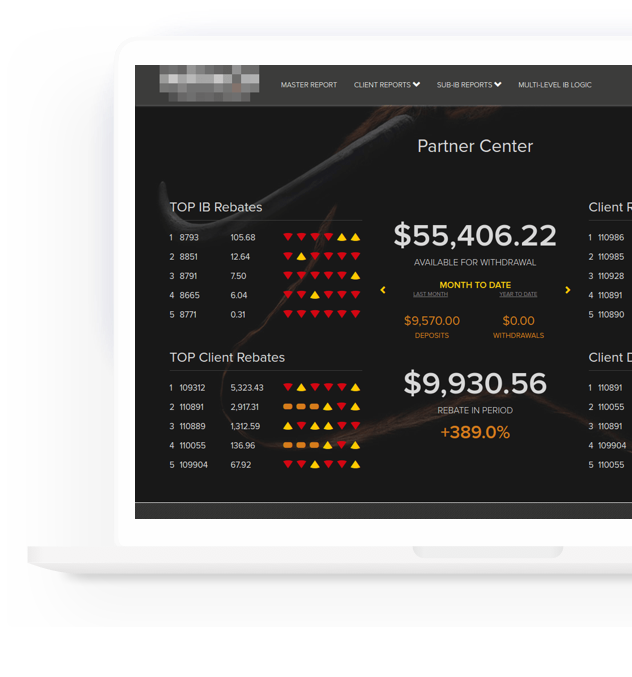

I have been working with Andrew and Ardas's team as CTO of INFINOX Global as a principal financial services client. Ardas's passion really stands out. I frequently connect the team to discuss strategic decisions and plans for the future.

Project Dates 2014 - Present

Project Summary

After successfully transforming this solution into an automated system we entered long-term support and evolution cycle and still update and tune this system according to customer requirements.

Read Case