How to Create a Custom Money Transfer App and Software

Simplification is the primary trend in the tech world. Easier to use interfaces, faster communication systems, money transfers in a few clicks – all of this has become a part of our lives. Internet is all you need for shopping, work, rapid financial transactions that used to take a few business days.

Modern money transfer systems compete with each other by simplifying all procedures. You can become a full participant in this game only by offering your customers something new. And, not surprisingly, this new one can be a unique approach, efficiency and a high level of security.

If you are thinking about building money transfer software or need help to improve your existing platform, you’re in the right place. Let's talk about all the critical points of such products’ development.

Сurrent Trends in Money Transfer Niche

According to the Statista Worldwide FinTech report, in 2022 digital payments will be the largest segment of the market. Experts expect that the neobanking will have revenue growth of 39.9% and the number of digital payments users by 2025 will grow to 4,929.55 million.

Under these circumstances, the competition of new startups and fintech giants is possible only if the first ones are ready to offer customers fundamentally new solutions to enhance the security of money transactions and make users’ life easier. However, despite the rapid growth in the popularity of digital payments, filling out customer needs is not easy if you don’t meet the current market’s trends. The main ones are:

-

Constantly growing consumer demand for digitalization. Your platform needs to be prepared for a sharp increase of users and fast scaling.

-

The merge of the money transfer market niche and the processing of payments. This trend is relevant for both new startups and existing systems. The capabilities of the payment industry can be used for faster and more transparent transactions, which allows you to reduce fees. Therefore, the blurring of the boundaries between the two niches is obvious.

-

Full implementation of regulations. Due to the negative consequences of the pandemic for the financial market, the governments of all countries will be more strict regarding the regulation of any financial transactions. Therefore, it’s essential to pay attention to the automation of control over the implementation of any rules.

-

Digital for customers. Any implementations should meet the users’ expectations, and your online money transfer system should be convenient for users with different levels of technology comfort.

Of course, each software can have unique features and work for a specific target audience. But, in general, it’s important to follow the trends described above.

The Main Types of Money Transfer Software

Depending on the recipient, all payment systems can be divided into three groups: P2P, B2B, B2C. Some of them were created for International money transfers, another for financial operations within the country.

P2P or peer-to-peer payment system involves online transactions between two apps for money transfer, from person to person. Accordingly, B2B carries out transactions between two business accounts, and B2C is a form of payment to business customers/clients.

All these platforms may have their own features, but their work is one way or any other determined by the way they operate. And if we talk about this indicator, there are three main types of such apps.

Standalone Services (famous PayPal, Venmo, etc.)

These are independent platforms. This kind of system offer clients to use bank cards (most often supported by Visa and MasterCard) and e-wallets for transactions. Such platforms are easy to use, fast, and don’t require customers to fill out a lot of documentation.

Mobile OS–centric Systems (Android/Apple/Google Pay)

These are integrated systems for mobile use that allow to make payments online and make contactless purchases through either PoS-terminals with NFC or wherever NFC is supported. Each system has its own characteristics (fees, requirements, etc.). For example, Apple users can only make P2P transfers to recipients with the same app. However, almost all mobile services provide fast transfers and are convenient to use.

Bank–centric services

These are custom solutions for banks and PoS systems. Almost every well-known bank has its own application or web-based money transfer software. However, some platforms don’t belong to a particular bank. A great example of such a system is Zelle. The platform has a network of more than 5,000 financial institutions and allows quick transfers from one bank account to another. The system has both a desktop version and applications for Android and iOS.

Also, money transfer software could be created for cross-border operations, currency transfers, etc. It depends on your target audience’s needs and desired functionality.

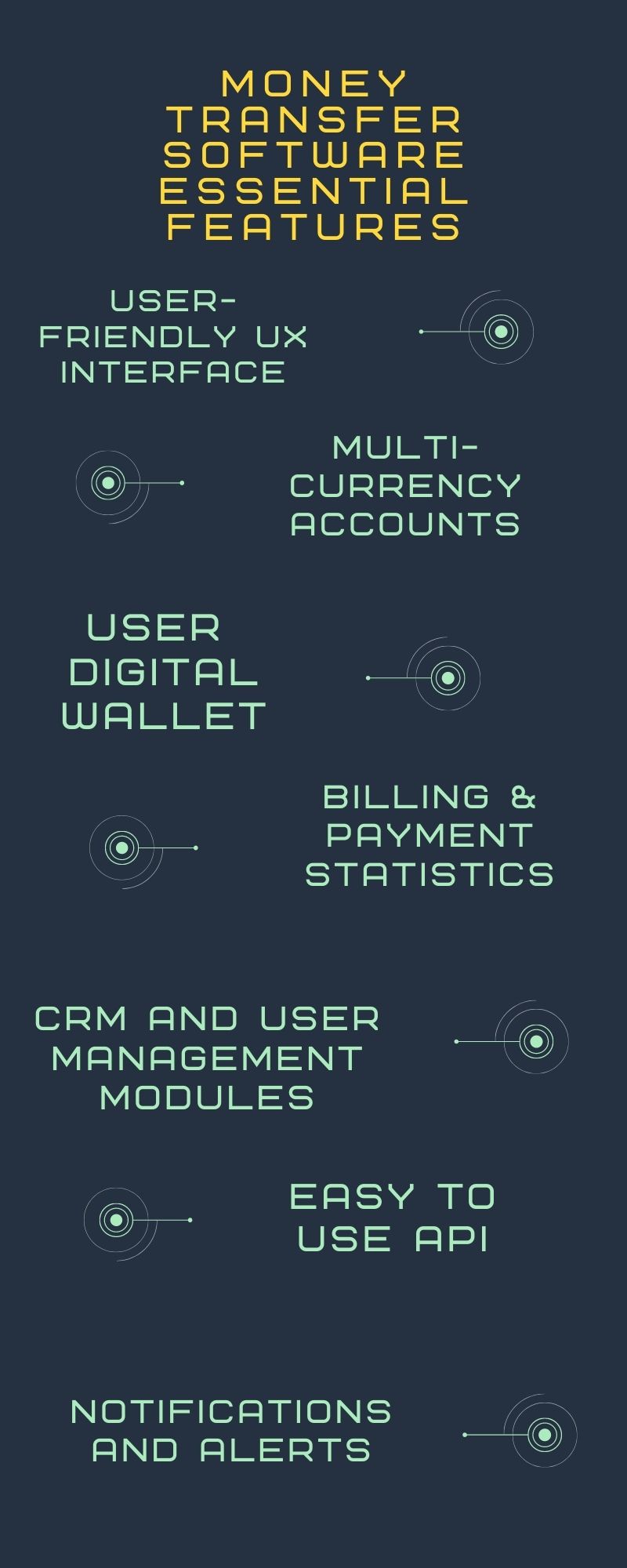

Money Transfer Software Essential Features

Any software has components without which it can’t work correctly. Money transfer platforms aren’t an exception. So let’s discuss the main features of such programs in more detail.

User-Friendly UX Interface

The first thing a customer sees when visiting your site or app is the interface. If it looks poor and is not easy to use, you lose your user. That’s why it’s essential to involve UI/UX designers in money transfer app development. They would make a cool interface that:

-

is adaptable to all possible devices (tablets, smartphones, alien computers :));

-

is multilingual, your application can be used by people from different countries;

-

provides smooth and convenient access to all functions.

Your interface should be user-friendly for people with different comfort levels with modern technologies.

Multi-Currency Accounts

Traditional currency exchange can be a pretty long and expensive process. Banks often require customers to visit branches to exchange or transfer money to a foreign currency account. Your app should have a more convenient and faster conferencing system.

That is what you need multi-currency accounts for. This feature allows users to receive or send money in the correct currency without undue stress, delays and waste of time.

User Digital Wallet (E-Wallet)

Like the physical one, a digital wallet is a place where the user's money is saved. A high-quality physical wallet allows you to conveniently place bank cards, cash, etc., in different slots. The principle of operation of the e-wallet is similar, but it’s needed to store bank card data, electronic funds, for making transactions, etc.

A digital wallet is a tool for contactless payments and financial transactions. Such a feature should be easy to use, secure, and allow the user to manage balances, check funds, etc.

Billing & Payment Statistics

Concise functionality is not enough for creating a money transfer app. In addition, you need to have tools for funds analysis and management.

Modern applications should also include billing and payment statistics. It helps your users see their expenses, analyze transactions, and make financial plans. Furthermore, visualization and analysis of transactions according to various criteria (recipients, status, countries, etc.) make their experience convenient, exciting, and smooth.

CRM and User Management Modules

The user accounts management is not possible without the integration of particular modules. Creating an application implies having separate interfaces for specific roles: administrator, cashier, etc. You’ll need this module for:

-

monitoring the activities of accounts;

-

accounts activation/deactivation, tracking users' activity;

-

creating a history of balance;

-

using promo codes and conducting other marketing activities.

The user management module and CRM are your tools for interacting with customers, so it's important to pay special attention to this feature’s development.

Easy-to-Use API

In money transfer app development, API integration is your primary tool for secure cross-platform connection with various world banks, MTOs, etc. Without this and other protocols, fast money turnover is just not possible.

Therefore, the integration of API is mandatory for the transfer of funds to different parts of the world. Moreover, it provides users access to their assets in various financial institutions.

Notifications and Alerts

Proper notifications and alerts are significant features for money transfer platforms. They are a way to inform customers about any changes or actions within bank accounts (debiting funds, transactions’ status, updating monthly subscriptions, etc.). You have to keep the clients informed because it’s also your safety and peace of mind.

On the other hand, a convenient messaging system can be an effective marketing tool. It allows users to send special offers, inform them about new products, features, discounts, etc. So feel free to use it in your promo strategies.

Of course, custom money transfer applications may have other features. It all depends on the type of software and its purpose. However, all the components mentioned above are required for any money transfer system operation. They provide not only the convenience of the system but also a high level of data protection, complete confidentiality and compliance with all legal requirements.

Steps to Create a Money Transfer App

Every software owner can face three main problems: the need for rapid scaling, regular security enhancements due to the spread of fraud, the basic outdating of soft.

A consistent system of money transfers app creation allows you to develop a strong product. It also leaves room for consistent growth and improvement. In general, the proper development process consists of several essential steps.

UX Concept & Prototypes

As mentioned above, the money transfer platform can be displayed not only on the desktop but also on smartphones, tablets or other devices. Therefore, the interface should be adaptable, easy to use and clear to understand. That’s why you need a pro UX design and a high-quality dashboard prototype.

At this stage, designers analyze competing applications, create a UX concept that suits the specifics of your platform. In its own way, good design protects the users from mistaken actions because it carefully guides them through the app’s functionality. UX design is also about the proper use of branding and highlighting the most important things. Specialists create a perfect concept and prototype. This is the basis of future application.

Money Transfer Software Development

This step is crucial in building a money transfer app because all the necessary functions should be integrated here. Developers create the interface according to the UX design prototype, implement user management modules, build a money transfer portal, e-wallets, etc.

The functionality of your software depends on the tasks performed at this stage. For example, will the transfers be fast and trouble-free? Will the conversion work properly? Will the data be displayed correctly? All these issues should be solved at this step.

Reporting and Accounting Implementation

Accounting and reporting are mandatory functions of money transfer platforms. With their help, users analyze profits and expenses, monitor transactions, and control their assets and bills. So real-time tracking of such metrics is another critical step toward quality software.

Security & Compliance Regulation

The development of any software requires the establishment of user safety. However, when it comes to everything related to money, the level of security must be the highest. It’s important to protect yourself and your customers.

Security & Compliance Regulation involves the integration of verification systems such as:

-

Know Your Customer (KYC);

-

counter-terrorism financing compliance;

-

Anti-Money Laundering (AML);

-

Authentication systems: two-factor authentication, Face/Touch ID;

-

Secure Sockets Layer (SSL), etc.

At this stage, developers also work with backups, data recovery, encryption, restriction and limits, etc. The right approach to integrating data protection and authentication technologies ensures first-class security for both your users and you as a business owner.

Cost & Timeline of Building a Custom Money Transfer App

Of course, the exact cost of a particular project can be called only after an in-depth analysis of the market, as well as determining the main features of the platform and quality requirements. Developing your own money transfer app can be more expensive than creating other software mainly because much attention needs to be paid to security and interoperability with other financial platforms. All this requires time and an extraordinary approach.

The average salary of developers in Asia is $ 25-50 per hour, in Latin America – $ 25-100 per hour, in Eastern Europe – $ 25-70 per hour, in the US – from $ 100 per hour. In other words, the total price and timeline of the customizable money transfer application development depend on invited specialists, used technologies, legal and marketing costs.

Ardas Experience in Financial App Creation

Fintech is one of our favorite areas of development because it allows us to overcome new challenges and create a truly unique product. The best way to prove our experience is to tell you about a particular project, namely a finance management SaaS application for courier companies.

Our client works in the field of transport services and has encountered several problems:

-

difficulties with account management;

-

lack of experience in mobile apps and web software development;

-

inability to see the full fund picture;

-

lack of user-friendly software to help automate financial processes and save time.

So our main task was to create a convenient financial management tool for courier companies with a reliable API. This application had to simplify and speed up the processes of:

-

Invoices export, booking and management;

-

PODs management;

-

status management;

-

documents coordination and verification, etc.

In other words, we needed to develop a solution that would automate all the financial procedures that courier companies encounter every day.

The development process included standard stages. First, we’ve conducted an in-depth analysis of the competing financial apps and logistics market. Then, based on the obtained data, we’ve created a prototype for further development. The process involved business analysts, product designers, DevOps, QAs, experienced money transfer software developers, etc. As a result, we have an up-to-date app with the following features:

Convenient and straightforward invoice management

We’ve created a UI interface that allows you to manage all processes related to invoices: receiving, uploading, adding credit notes with bank details, etc. The functionality also allows you to check balances, add payments received on invoices, etc. In addition, the user can manage the company's and the providers’ bank details.

Fast transfers and streamlining of financial relations

We’ve collected PODs, invoices, credit notes, load docs, and others in one record for easier transaction management. Creating invoices and making payments has become much more manageable.

We’ve also improved interaction with drivers and couriers. For example, the finance department can contact them to clarify the invoices, approve the record and plan payment dates.

Illustrative statistics and data analysis

We’ve developed an audit log that can inform the user of all actions that have been taken. This is necessary for operations control and preventing fraud. This journal contains all historical data.

Users can also use visual statistics to evaluate their own assets and share the results with customers or suppliers. The data analysis system allows you to conduct a professional financial review of the business with the help of visualization, convenient filters, aggregation by region, etc.

Integration with Xero and QuickBooks

We chose Xero and QuickBooks for integration as they are the most popular financial CRM in the UK transport industry. This solution allowed to automate the accounting system, including the process of sending invoices. This not only simplifies the process of working with finances but also saves the client money.

Our client was well acquainted with the peculiarities of the market. This MVP quickly met the client’s needs, so the project began to grow quite rapidly. We’re still collaborating and developing the tool together.

How to Integrate Ready-Made Payment Solutions API?

In the case of money transfer systems, your app needs to store and process bank card and account data. Therefore, your payment method must meet the Payment Card Industry Data Security Standard (PCI DSS). Otherwise, your users won’t be able to use Visa, MasterCard, etc.

To be compatible with the PCI, the payment method should pass the attestation of conformity, determine the level of responsibility, and several other circles of bureaucratic hell. To create a custom solution, you have to spend a lot of time and money on this process, not to mention the development of the software itself.

Ready-made payment solutions are PCI DSS compliant, which means that they are responsible for storing, securing and verifying each transaction. So all you have to do is integrate the system.

Such solutions have many advantages. First of all, it’s much easier to integrate a ready-made secure payment method than to build it from scratch. Secondly, popular companies provide full customer support, including connection, setup, and more. Finally, they are compatible with almost any product.

The integration process can occur via coding or via APIs to your server. The second option is most often used. Vendors have handy integration guides, so developers just need to follow the instructions.

Final Thoughts

Contactless payments are an area that is constantly evolving and taking over the world. It’s forward-looking, exciting, and will definitely become an integral part of our future, as more and more people are giving up cash and paper transfers.

Now you know that there are three main types of money transfer software: standalone services, mobile-OS centric and bank-centric systems. The main stages of development for any of them are in-depth analysis, UX concept and prototype creation, software development, reporting and account implementation, and security stage. In addition, each app must have such features as user-friendly UX, e-wallet, payment statistics, etc., for successful operation.

We love fintech and we have experience in custom money transfers software development. Feel free to contact us in any convenient way. We’ll be pleased to answer all your questions.