How to Create a Neobank From Scratch: Features, Development Process & Challenges

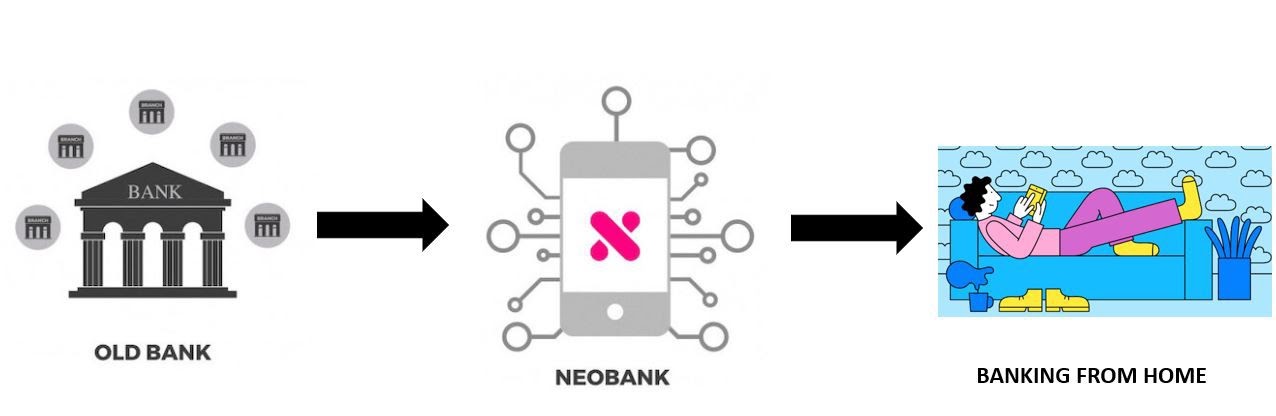

The banking sector of the fintech industry has been actively transforming over the last five years: the number of neo-banks in the market is increasing, the classic branches are closing, and the customer is confidently moving to digital.

Today's students are a generation of people who will most likely never go to a bank branch in their lifetime. This does not mean that they will not use banking services. On the contrary - they will actively pay non-cash, take loans, and open deposits, but all the interaction "bank-client" will take place in their smartphone. And it is for this audience - Generation Z - that non-banks are already competing today.

Evolution of Traditional Banks Instead of Revolution

In the US market, neobanks have become known as Challenger Bank, as they have challenged the system and gone beyond traditional service. They differ from the classic ones, first of all, by their own high-tech IT infrastructure. This is the basis for creating innovative banking products and processes, integrating databases and collaborations with other services, which allows you to quickly adapt to change.

Important differences are also the absence of bank branches, 100% bank-client interaction online, fast client onboarding (approximately 35 clicks) and convenient UX / UI mobile application, more favorable terms of deposits and loans, and at the same time - comfortable service with customer support.

Yet neobanks have transformed the industry, albeit not in the way analysts had anticipated. They didn’t oust the monopolies from the market, but they changed the standards - thanks to them, mobile banking began to develop, the range of digital banking services expanded, and competitors began to pay more attention to the UX and design of their applications. Compare the interfaces of banking applications five years ago and today: they have become more user-friendly and responsive, although they still require additional effort from the user. For example, to open an account with HSBC, you need to make 99 clicks, while in Revolut - only 24.

Neobanks have partly stimulated the development of ecosystems in the financial sector. It would seem, why does a bank need a food delivery service or a streaming platform? And why turn a branch into a pick-up point? Each additional add-on helps to better understand the needs of the audience and offer them more relevant financial products. Neobanks, with their approach to UX and analytics, initially had an advantage: with less data, they got more value out of it because they better understood their target audience.

Another feature is flexibility and adaptability. For example, American startup Chime found that millennials prefer debit cards to credit cards, but at the same time want to improve their credit score. Then neobank launched a hybrid product that combines debit and credit functions. Much of the flexibility is due to the less developed infrastructure of neobanks: they do not operate a huge range of financial services, so they are riskless. Conventionally, one failure will not lead to multi-million dollar losses, so it is easier for them to experiment. And it is easier for large banks to integrate ready-made start-up solutions into their ecosystems than to create their own product from scratch.

At the same time, formally, both neobanks and “conservatives” still work according to a similar model, the only difference is in the “shell”. Moreover, in an effort to increase margins, neobanks are borrowing the tactics of traditional banks. So, the British startup Monzo at some stage planned to launch a financial marketplace, but after receiving a banking license, it followed the classic path: it introduced overdraft accounts and started issuing loans directly.

While neobanks are following the traditional path, new products are being launched by software development companies. They are gradually offering more and more financial services, capturing new niches, and in terms of UX and convenience, they are not inferior to neobanks. Analysts admit that the conditional Google or Apple will soon become the largest fintech company, and banks, in principle, will not be needed.

How Neobanks Work

There are several variants of models for organizing neobanks in the world.

Full Banking License Model

Some neobanks have received a full banking license, and their regulation is no different from ordinary banks. At the same time, specifically for the needs of neobanks, a number of countries have introduced a limited type of banking licenses, which are provided as an intermediate stage before obtaining a full-fledged banking license. In such cases, neobanks were able to increase their resources for a full-fledged entry into the banking sector without reducing requirements from the regulator. This type of license is available, for example, in the UK and Australia.

Example: Monzo (UK).

Cooperation Model With Another Bank

Another model is that neobanks cooperate with existing banks. In this case, all obligations to adhere to regulatory requirements, along with credit risks, lie with partner banks, while neobank provides only technological solutions.

Example: Chime (USA).

Mixed Model

Some neobanks only obtain licenses for some financial services and conduct other activities through partnerships with conventional banks. For example, in Europe, the EMI (Electronic Money Institution) license permits a neobank to issue cards, transfer funds, and issue electronic money. Other services, such as opening deposit accounts, can be provided by neobanks only through cooperation with ordinary banks.

Example: Bnext (Spain)

Neobanks in Ukraine

The number of contactless payments and online payments in Ukraine is growing. According to Mastercard, in the first quarter of 2020 compared to the fourth quarter of 2019, their number increased by 7% and 8%, respectively. Ukrainians are actively making payments online, especially now that they have to spend more time at home, in isolation, and in quarantine. It's fast, convenient, and safe. Given these trends, all businesses, without exception, are adapting and digitalizing - traditional banks are no exception.

According to the Mastercard survey conducted in 2019, Ukraine is among the top ten European countries in terms of NFC payments and ranks 4th in the world in terms of growth rate, surpassing Poland, Canada, and a number of European countries. Over the past two years, we have increased 90 times the transactions of contactless payments using a smartphone and the number of connected devices for NFC payments is growing by 25% every month. A Kantar MMI study published in October found that every 5th smartphone owner between the ages of 12 and 65 uses ApplePay or GooglePlay once a month and more often. This is about 1.7 million Ukrainians.

This situation contributes to the emergence of new neo-banks in our country. The user gets more and more opportunities on better terms and therefore increasingly prefers "banks in the smartphone". And the competition motivates the latter to develop and fight for the customer, offering him a more convenient mobile application and more favorable conditions.

For example, in Britain, which is considered the locomotive of the world's neo-bank, today more than 125 players successfully coexist. High competition in the market allows them to keep each other in shape and keep improving, which often happens in stable markets.

This is especially important in a fast-paced and volatile market, aimed at capturing a young demanding audience of millennial users (digital nomads). Therefore, non-banks "play" not only and not so much in the field of financial services, as an intermediary for the client and give him a convenient tool to meet all needs. Want to buy a train ticket - easy, order a taxi - no problem, pay utilities - please, book a table in a restaurant - two clicks. And still, get a profitable cashback for it. And most importantly - to do so could be easy.

Neobank Core Feautres

Neobanks are simple and extremely convenient to use. Their smart and interactive features are designed to help you better understand and improve your cost-saving habits. For example, you can set up expense alerts and auto-savings across many of the platforms they offer.Cross-border Payment

Striving to revolutionize banking for millennials globally, neo banks are offering global banking solutions aimed to make cross-border banking smarter, faster and better.

Billions of USD are remitted abroad per annum, in terms of expenses such as overseas education fees, maintenance of close relatives, investments in foreign equity, deposit, travel etc.

A majority of these remittances happen through public sector banks. These branch-based banks, with legacy technology, involve extensive paperwork. Industry experts say, there is a lack of transparency and an inherent distrust with the banks. There are also various freelancing agents with a network of 100-150 customers. However, such freelancing agents usually end up charging as high as 2-3 percent per transaction.

Cards Issuance

Neobanking is also taking card issuance to a new level. In the sense that now physical cards are becoming optional at all. You can create a card in your application online and pay for all purchases using the phone to which the virtual card is attached.

Savings Features

Thanks to the new possibilities of online banking, it becomes unnecessary to buy a porcelain pig-box, in which money is usually saved for short-term purposes. The piggy bank function is now available in most modern banks. In doing so, you can also open long-term savings accounts.

Budgeting Assistance

This function allows you to track your card spending for a month and adjust expenses. You can schedule mandatory payments in advance and not worry about overdue invoices.

Cryptocurrencies

And finally, in some countries, it is already available to store your savings not only in standard currencies but also in cryptocurrency, make transactions between accounts, sell and buy.

Neobank Development Process

What exactly is involved in developing a neobank from scratch? The question most often asked by our clients. They want to know how much money and time it will take from them, how the work is structured, where to start, and how to earn and not lose as a result.

Discovery Phase

Every application starts with an idea. You tell us what tasks the future service should solve, and we start collecting analytics. A deep cut of the market, analysis of existing solutions, the study of competitors and customer behavior patterns ... At each stage of the analysis, we remember the end-user and think over the customer's life cycle. This helps us together understand how people will use the new application - and make it as user-friendly, understandable, and useful as possible. This service will benefit your business as well. As a result, we get references for functionality and design.

Design

We are compiling a detailed description of the functionality and design of the future application. We define the characters of users, describe the User Story, draw up a Customer Journey Map and form the technical requirements for the service. That is, we fix what the application should be like, what it should be able to do and how it will work.

Thanks to such a technical assignment, our team of designers and developers clearly understands what kind of service the customer wants to receive, and gradually implements the initial idea.

Development and Testing

After agreeing on the technical specification and prototypes with the customer, the stage of active development begins. In complex and complex projects, it is recommended to use MVP (minimum viable product) - the minimum implemented functionality of the product, which helps in assessing the future application on the part of the customer and in further development planning.

After development is complete, you need to test the final version on mobile devices. At this stage, they identify and clean up all the roughness and flaws of the application, prepare it for a full release.

Challenges of Building Own Neobank

As in any other area, when developing a new product, you will surely face a number of challenges that you should be prepared for in advance.

Compliances & Regulatory

On May 25, 2018, new rules for the processing and protection of personal data came into force - EU regulation 2016/679 of April 27, 2016, or GDPR - General Data Protection Regulation. This directive is a direct law and is automatically implemented through national law in all member states of the European Union. However, this legal provision is extraterritorial and affects not only companies located in the EU, but also all others that collect and process data from EU residents and citizens.

Open Banking is a fundamentally new type of banking that was originally intended to improve market competition, stimulate innovation and offer more personalized and more beneficial services to end-users.

In terms of the Second Payment Directive PSD2, which is the legal framework for Open Banking in Europe, it is a pan-European regulatory scheme that obliges banks to exchange data with third-party service providers (for example, fintech companies, various start-ups) at the request of customers via the Open API. In other words, it allows fintech companies or other third-party services to access a customer's financial information or conduct financial transactions. The more participants in this system, the higher the competition, which means that the variety and quality of services in the market will increase and prices will decrease. This will ultimately benefit the end-user.

Therefore, when creating your application, carefully study all the documentation that you need to consider building your own neobank.

Wrong Infrastructure

Neobanks have a constantly growing load as the number of users grows. Therefore, a monolithic project structure will not work, and to avoid problems it is worth breaking it down into internal subsystems.

Lack of Expertise in Team

The wrong team will not be able to deliver the expected result and will burn money. It is important to remember that the business owner wants to see the result, not the process. Since the neobanking niche is still relatively new, few of even the brightest minds in development understand exactly how to create such a product. Therefore, it is important to have an experienced CTO in the project who can select people for the team who understand what they are working on.

The Future of Neobanks

The future is not for neobanks, but for the neobank model - virtual services will become a standard in many areas, including the financial sector. At the same time, heightened competition with IT giants will lead to an even greater blurring of boundaries in fintech. Tech companies will provide financial services, while banks, on the contrary, will offer digital services.

At the same time, the development of Open Banking, namely the emergence of open programming interfaces and the creation of conditions for the free exchange of data, will provide startups with more resources for growth. This will allow them to find new niches and create fintech add-ons that will generate the bulk of the revenue. Therefore, neobanks will gradually rely not so much on end-users as on b2b services for small and medium-sized businesses, freelancers and self-employed. As startups grow, they will create their own platforms and ecosystems, this will help them strengthen their position in the market, but at the same time, it will intensify competition, as the border between traditional players and neobanks will finally be erased.

Final Thoughts

Neobanks is a promising trend in the global financial system. It is unlikely that they will completely replace the traditional ones, but, obviously, they will become more and more every year. The weak will die, the strong will become stronger. And most likely in the next few years, we will see a new trend in the banking sector: a kind of hybrid of neo and classic banking. For example, traditional banks will increase the direction of digital on their side and at the same time consider the possibility of mergers and acquisitions (M&A) with non-banks, provided the relevant value for money.

Working with the fintech industry for many years, our dedicated software development team can help you bring such projects to life and implement them within a reasonable budget and time frame.