Business Challenges We Solve

Adopt Artificial Intelligence

Modernize Legacy Banking System

Digitize Banking Services

Personalize Customer Expirience

Banking Software Development Services

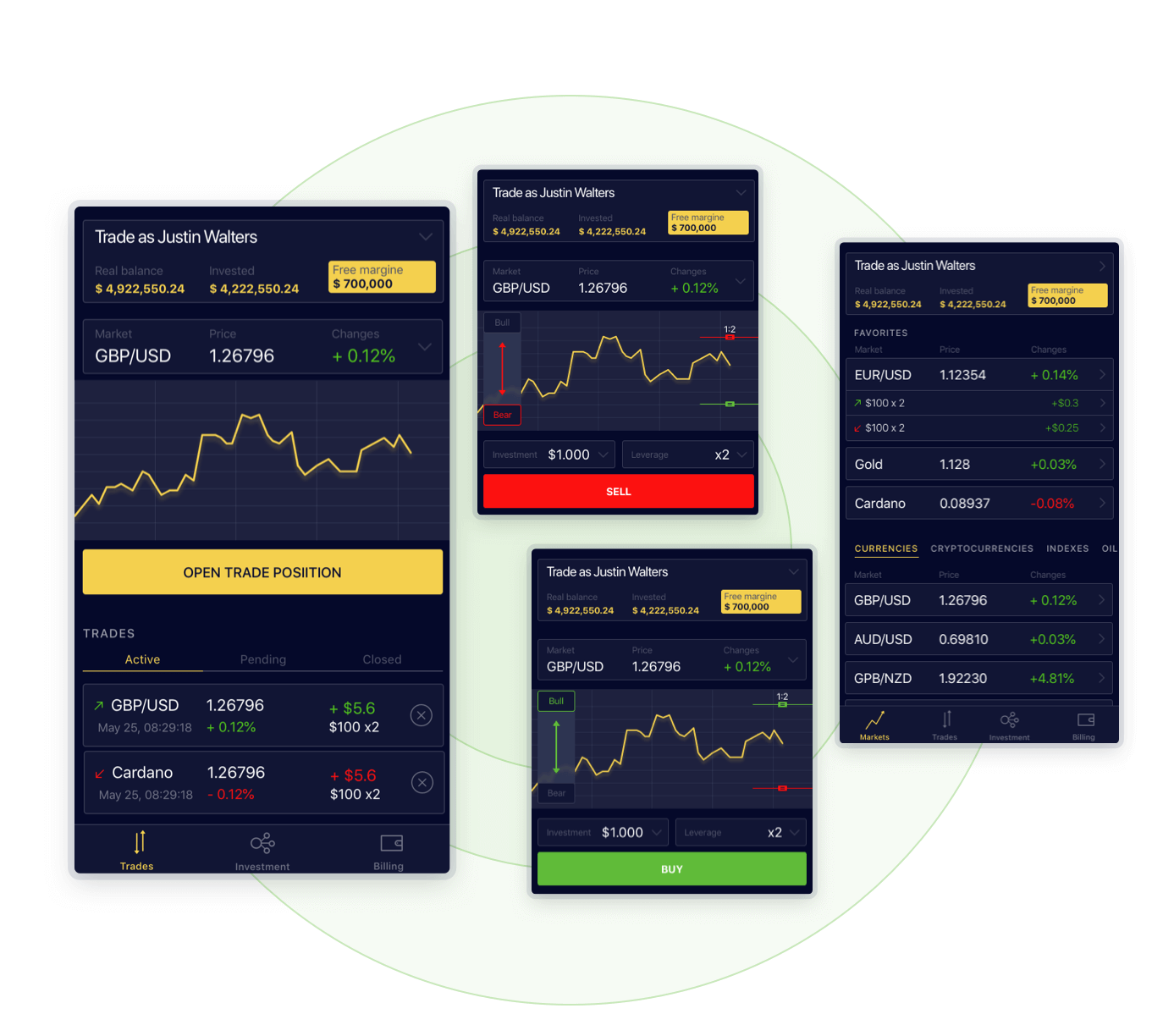

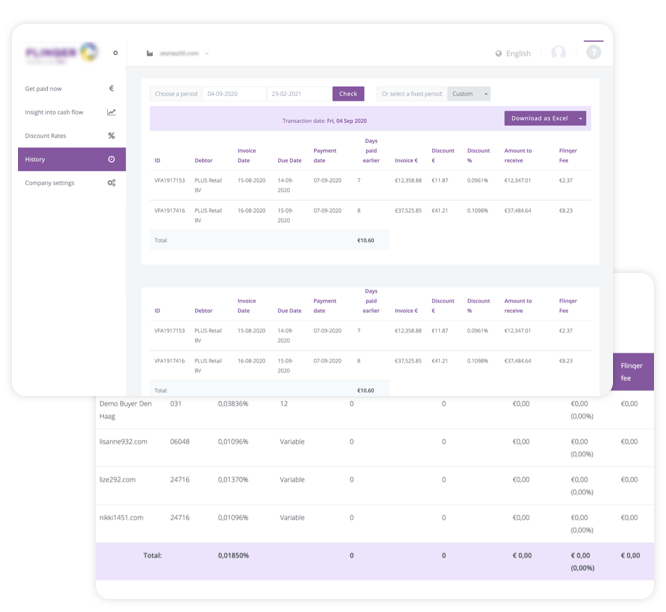

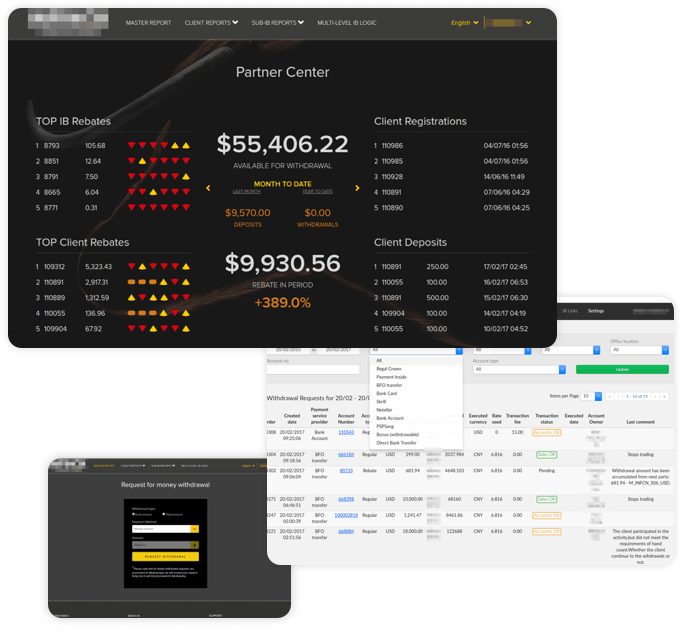

Successful Fintech Cases

Check these financial tools we are now engaged in. Three great cases of very different businesses on their very different stages and levels of success.

Why choose ardas

Transparency

Every hour of work is used efficiently.

Every movement and every hour paid for makes sense

Experienced Team

We start a team with the most relevant engineers who already had experience in banking software development. So they are ready to use it in your area of business.

Established Processes

We’ve been honing the processes we apply throughout our SDLC for 17 years based on experience on projects big and small

Simple Billing & Payment

Once a month, according to the company invoice, and not to each employee (i.e. minus the extra accounting headache and costs).

Expertise in Bank Industry

We've already developed a bunch of banking systems so we know all pitfalls and customers needs.

No Legal Costs and Headache

We make sure that everything is legal from our side, so we provide accountants and legal advisors, payroll, and taxes.

Banking Software Development Process

What do We offer?

We work hard to create safe and confident custom support processes.

Banking Software Upgrade

Upgrade your technology stack to optimize maintenance, simplify support and boost performance;

Scaling and Integrating Banking System

Expand your system with required features or third-party services;

Cloud-based Banking Infrastructure

Cloud providers have extreme security standards and a track record. Environments can be more secure than on-premises, but only when implemented by a skilled team. Better integration of business units through sharing data and moving more quickly to solve customer problems;

Team Engagement Models for Banking Software Development

Recognitions

and Partnerships

We have been in banking mobile development services since 2005

If you need help in building banking software development accurately meeting your needs, get in touch with our experts and discuss the solution. It is FREE and we engage fast. We will help you to gather right experts with big experience in custom development and deep understranding of a particular field.

Ryzhokhin