Business Challenges We Solve

Optimize Loans Origination Process

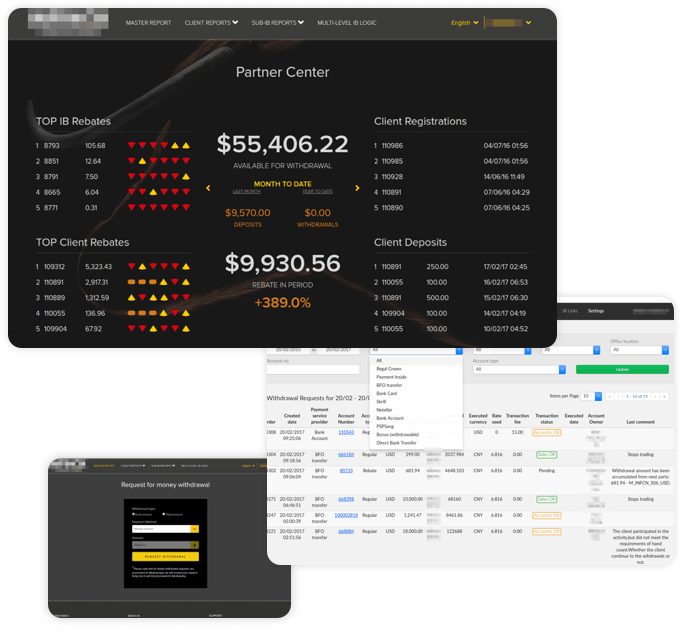

Minimize Credit Risks by Tracking and Reporting

Set Up End-to-End Lending Process

Keep Up With Regulations

Lending Software We Build

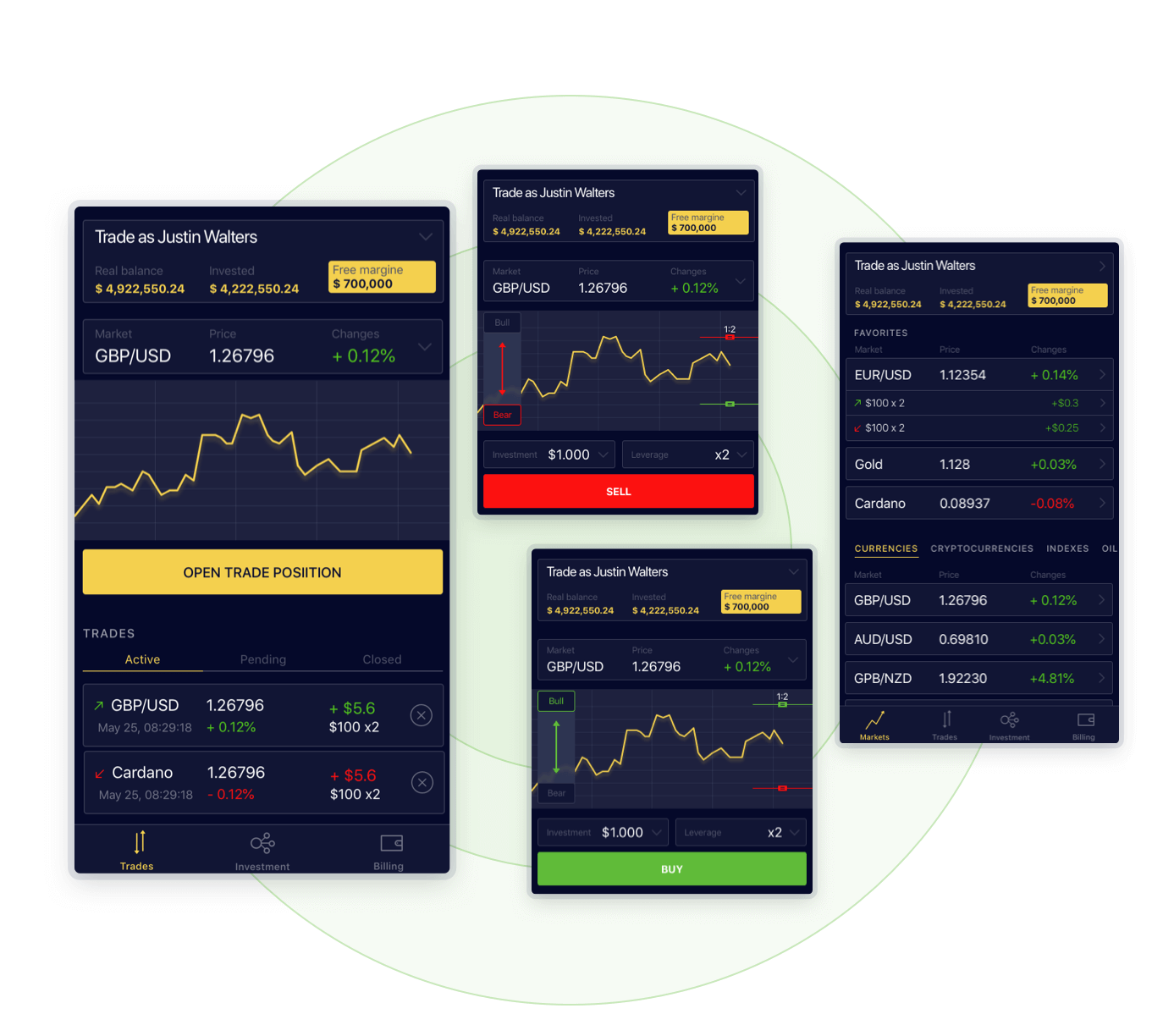

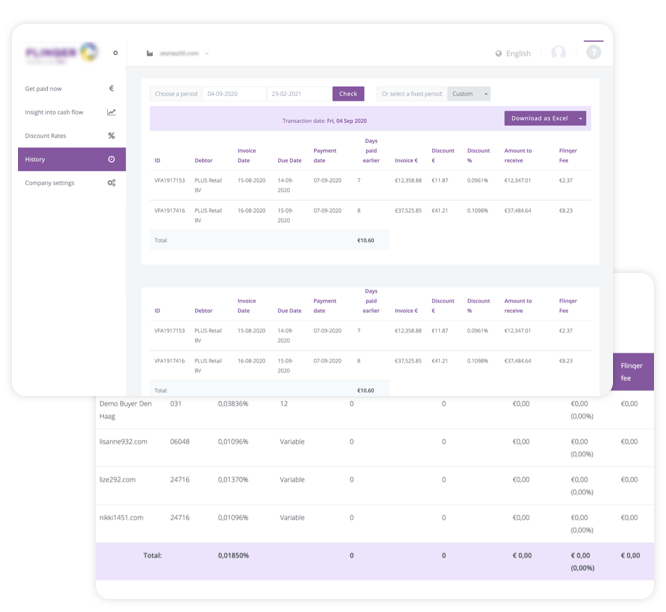

Successful Cases

Check these financial tools we are now engaged in. Three great cases of very different businesses on their very different stages and levels of success.

Why choose ardas

Transperency

Every hour of work is used efficiently.

Every movement and every hour paid for makes sense

Experienced Team

We start a team with the most relevant engineers who already had experience in banking software development. So they are ready to use it in your area of business.

Established Processes

We’ve been honing the processes we apply throughout our SDLC for 17 years based on experience on projects big and small

Simple Billing & Payment

Once a month, according to the company invoice, and not to each employee (i.e. minus the extra accounting headache and costs).

Expertise in Bank Industry

We've already developed a bunch of banking systems so we know all pitfalls and customers needs.

No Legal Costs and Headache

We make sure that everything is legal from our side, so we provide accountants and legal advisors, payroll, and taxes.

Lending Software Development Process

What We Offer?

We work hard to create safe and confident custom support processes.

Reliable Decision-Making Algorithms

Automate loan origination, ensuring a fast application process, credit and risk scoring, and top it up with a quick disbursal and loan life-cycle calculation;

Cloud-based Lending System

Credit applicants can use a mobile interface to submit necessary documentation, and an artificial intelligence-powered risk engine;

CRM Solution for Client Management

We provide end-to-end CRM implementation services to consolidate data across channels, build up all-round customer profiles, connect corporate silos, foster collaboration, and increase customer acquisition to help you meet the projected ROI for your CRM project. Whether you need to manage leads, sales pipelines, or onboard customers, our CRM solutions are totally customizable so no training necessary;

How Does Our Custom Lending Development Company Cooperate

Technologies for Lending Development

We use very different technologies, frameworks, and tools for lending project development and always pick up the most optimal combination for a customer to achieve the best result, reduce the cost, and speed up the development process.

-

Backend

Java

NodeJS

.NET

PHP

-

Frontend

ReactJS

VueJS

AngularJS

-

Mobile

React Native

Flutter

-

Data Science

Python

-

Clouds

AWS

Google Cloud

MS Azure

Recognitions

and Partnerships

FAQ about Lending Software Development Services

If you consider developing a lending solution, there are many questions might arise in your mind, and we are ready to answer to few of them right now.

How Much Does It Cost to Build A Lending Platform?

The price per hour is the lowest with dedicated development model, because the payment is made monthly for the full-time work of a specialist who is not distracted by other projects, so the risk of not completing the work in time is minimal.

How Do You Build A Lending System?

Ardas technology partner responsible for every task, including business analysis, development, QA, and DevOps. In total, from 8 up to 30 specialists can be involved in the custom development, including frontend and backend developers, developers responsible for R&D and integrations, a mobile app developer, a DevOps engineer, QA engineers, a business analyst, and a project manager.

What Features Should Be in Lending Software?

From the time the loan is closed until it’s paid off, the Ardas loan servicing system streamlines the entire business process.

- Set up calculations for a number of product types

- Keep your business compliant with loan operation regulations

- Automate credit disbursement

- Configure, calculate and track payment schedules

- Perform day-to-day calculations for accruals, write-offs

We have been in lending mobile development since 2005

If you need help in building lending software accurately meeting your requirements, get in touch with our experts and discuss the development solution. It is FREE and we engage fast. We will help you to gather right experts with big experience in custom development and deep understranding of a particular field.

Ryzhokhin