Forecast for the development of fintech trends: banking applications will be replaced by embedded finance

Despite strong turbulence, global trends in the financial sector remain the same: increased inclusion, improved customer experience, and the development of the digital economy. Consumer demands determine the vector of changes in the industry.

Banking outside banking applications

If we talk about the comfort of the client, it is logical that the attention of investors is directed to the convenience of payments. Making an online purchase quickly and effortlessly is ultimately more important to the user than the design and functionality of banking applications. This led to the emergence of the fintech Stripe, Affirm, and GoCardless, which specialize in embedded finance.

More recently, the client did not need much from the bank: to keep his hard-earned money and be able to withdraw and spend it. Then fintech appeared, and it turned out that you can solve your financial issues quickly, remotely, and in a few clicks. As the ecosystem of these indispensable applications has evolved, tech companies have reimagined the once-complicated processes of opening a bank account, transferring money to friends and family, applying for a loan, or managing investments.

However, the next stage will be going beyond special applications called embedded finance - when a non-financial company creates financial services for clients, embedding them in their products. The idea of "invisible finance" is not new, but thanks to technological advances, the financial services pie is becoming attractive to the non-financial sector. With access to massive amounts of user data, e-commerce giants can create unique financial products that can be easily sold to their loyal audience.

The leaders of the embedded finance sector

One of the most talked-about embedded finance projects was the Apple Card in 2019. With the help of Mastercard and Goldman Sachs, the company has created its financial instrument built into the Apple ecosystem. You can remember Facebook Pay, with the help of which users can purchase goods and services of the network's communities and partner companies or make donations to charity.

eCommerce platforms today also offer built-in financial products to users, among which installment purchases are popular among the first to implement their financial services, Shopify and Amazon eCommerce platforms. The convergence of financial services with other products is taking place in various areas. For example, Google maps allow users in the United States to find and buy parking spots through an app interface.

Providing their digital infrastructure for lease to online trading platforms has opened up new opportunities for banks (banking as a service - BaaS). A BaaS user leases the "capacity" of a financial institution to the extent required. As a result, the clients of the "tenant" can perform standard banking operations (checking balance, payments, viewing the history of transactions) without interacting directly with the bank.

Nevertheless, the players in the financial services market rightly fear such competition. The giants Apple, Amazon, Facebook, Google, own a large amount of user data and a huge customer base. No fintech can compete with them in this. Moreover, the rivalry between companies will no longer be conducted at the level of a specific brand but at the ecosystem level from partner companies. However, this process is already irreversible. Payments, wallets, and similar banking services will become part of Internet companies that will take market share from financial institutions.

Opportunities for Embedded Finance

The beauty of embedded finance is that it streamlines financial processes. Before the development of embedded finance or banking, there was usually a gap between consumers and the companies they did business with. The consumer often needed a traditional financial services provider, such as a lender or bank, to bridge the gap. The bank would provide the credit or debit card a consumer used to pay for a purchase, or a lender would give a person a loan to buy a house, car, or other large purchase.

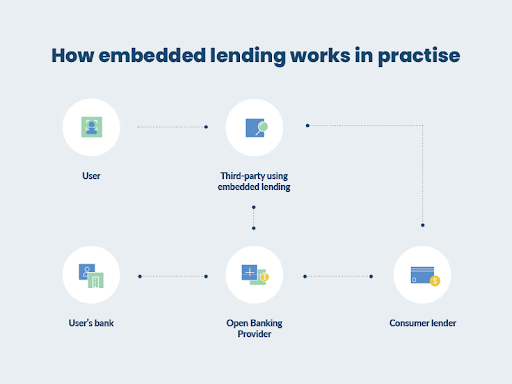

With embedded finance, that third-party bank or lender disappears. Embedded finance companies have found a way to act as the bridge or close the gap between themselves and the consumer. Look at some embedded finance use cases to see where you can make room for your own company within this sector:

1. Embedded payments

Sometimes, paying for a purchase hurts. Paying with cash causes consumers physical pain. In some cases, that pain can be enough to make someone reconsider a purchase. Embedded payments make buying pretty much pain-free for customers. Instead of digging into their wallet for cash or finding their credit card, a consumer using an app with an embedded payment program simply taps a few buttons and they're all set.

Examples of programs that feature embedded payments include ride-sharing apps like Uber or Lyft. When you take a ride using one of those companies, you don't have to hand the driver cash at the end or pull out a debit or credit card to pay. Instead, you complete the transaction in the app after the ride is over.

Fans of the coffee chain Starbucks can also use embedded payments. The app lets people order and pay from their phones. It also rewards them with points, which can be redeemed for future purchases.

2. Embedded card payments

Debit cards allow companies to simplify the process of paying contractors or employees. Instead of cutting checks or issuing direct deposits, companies can deliver payments to their own branded credit cards. In exchange for a white-label debit card, the company can agree to pay the card-issuer all or some of the interchange fee.

One example of a company that uses cards to streamline payments is PayPal. Users have the option of linking their PayPal account to their bank account. They can also apply for the company's cash card, which gives them direct access to the balance in the PayPal account. Instead of waiting a day or two for the cash to hit their checking account, a person with a cash card can use it immediately by paying with the card or using it at an ATM.

3. Embedded lending

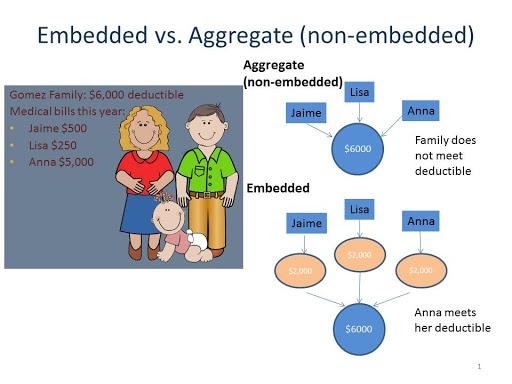

In the past, if someone needed to borrow money, they could apply for a loan from a bank or open a credit card. Now, embedded lending lets someone apply for and get a loan right at the point of purchase. Embedded lending use cases include Klarna and AfterPay. Both programs let a consumer split an online purchase into several smaller monthly payments. A $100 payment becomes four installments of $25, for example.

4. Embedded investments

To the average person, investing often seems complicated and out of reach. Embedded banking programs that simplify the investing process aim to change that. One example is Acorns, a program that invests people's spare change by rounding up purchases. Using Acorns, investing becomes seamless and touch-free.

A user doesn't even need to remember to transfer money to their account, as the app takes care of that. Their portfolio is automatically adjusted based on what the market does, so an Acorns user doesn't have to pay attention to the values of stocks or mutual funds.

5. Embedded insurance

Embedded insurance programs eliminate the insurance agent or broker from the process of purchasing an insurance policy. Traditionally, buying insurance was required for purchasing a car or home. It was also an entirely separate part of the process. To speed things up and increase their bottom lines, some companies have found ways to embed the action of applying for an insurance policy into making a major purchase.

One example is the carmaker Tesla. It offers an insurance program that lets people purchase the appropriate amount of coverage nearly instantly. Insurance available directly from Tesla also tends to cost less than a policy from a third-party insurance provider.

6. Embedded banking

Embedded banking isn't just another term for embedded finance. There are also instances of companies offering banking services designed to replace traditional financial institutions' checking or savings accounts. Embedded banking examples include the debit card from Lyft, which lets drivers instantly get paid by the ride-share company. Drivers can also set up a separate savings account through the program.

Shopify offers a similar embedded banking use case for businesses. Shopify's banking feature aims to encourage small business owners to set up a separate bank account for their company rather than use their checking and savings accounts.

Final thoughts

The SaaS development of embedded finance makes the market more democratic. The client gets access to the service when he needs it, and it is much more convenient than going to the financial institution's website. Digital payments, loans, and insurance can be offered depending on the need, increasing company conversions. Financial product providers, in turn, gain access to new audiences. In addition, the cost of the product itself is reduced. All this will allow us to rethink the essence and principles of providing financial services. But realizing these new capabilities will require a change in operating models. Financial institutions need to understand how they fit into other ecosystems, platforms, and the changing daily lives of customers.

If you are up to using embedded finance in your project, our dedicated development team is always ready to assist and implement your ideas as fast as possible!