Why Nordics are the most leading in fintech development

The fintech landscape in the Nordic and Baltic regions continues to be one of the most successful at producing unicorns. One recent example is TransferWise from Estonia that has become the most valuable fintech in Europe. Furthermore, the increased investments and new initiatives made by governments in the Nordic and Baltic regions are set to facilitate the continued success of the fintech region in the years to come.

Let’s review the latest north fintech development trends and how it affects the global market.

Fintech services after 2020

Long before the COVID-19 pandemic sparked a wave of speculation that consumers would shun physical currency in favor of contactless payments for the foreseeable future, cash was on the decline. The growth of e-commerce, fintech innovation, and mobile wallets have combined to see cash’s share of global payments nose-dive over the past decade. According to the 2020 McKinsey Global Payments Report, across select emerging markets, the share of cash payments dropped from an average of 95.7% in 2010 to 77.9% in 2020. In mature markets, the proportion plummeted from 58.9% to just 28.1%.

Challengers have become established players. Ideas that originated in Northern Europe can now be found in products, services and solutions around the world. The region has all the building blocks in place to generate wealth and opportunities. Inherently open, transparent, and internationally focused, the landscape is one of the ambitious fintech, cautiously enthusiastic banks, innovative ideas, and global vision. Capital investors, smart regulators, specialist accelerators, and even an engaged customer base are all present. The most important ingredient of all – confidence – can be found in abundance.

And yet… the region still has plenty of unrealized potential. Too many of the players are talking at cross-purposes. Viable, effective partnerships are the subject of much debate but little action. The ecosystem has not found a way to connect the various disparate component parts. Banks and investors talk of their engagement with the fintech community, but the messages – and the support that comes with them – aren’t hitting their target. Too many feel that banks have a stranglehold on customers who are unwilling to relax. The landscape is still one of the fiefdoms that don’t fully trust one another, rather than a united realm with a single, mutually beneficial purpose.

Evolving fintech industry

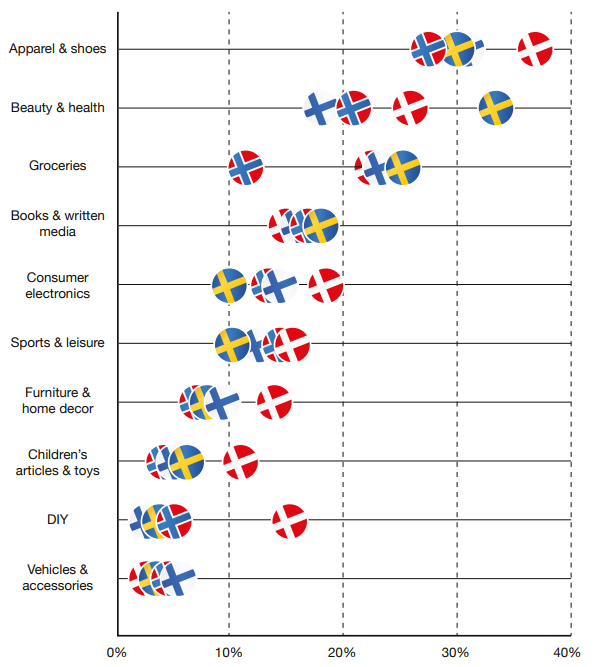

While Nordic countries stand out for their rapid and widespread adoption of non-cash payments, the same general trend is unfolding across developing and developed countries alike. With the customer experience now seen as the holy grail for businesses of all stripes, supporting alternative payment methods offers customers choice and convenience.

Meanwhile, digital payments solutions now on the market provide lower costs for merchants while also delivering better payment security protection and making it easier to comply with anti-financial crime regulations. No less important, integrating non-cash payment options is critical for businesses looking to expand globally, particularly in the age of cross-border e-commerce.

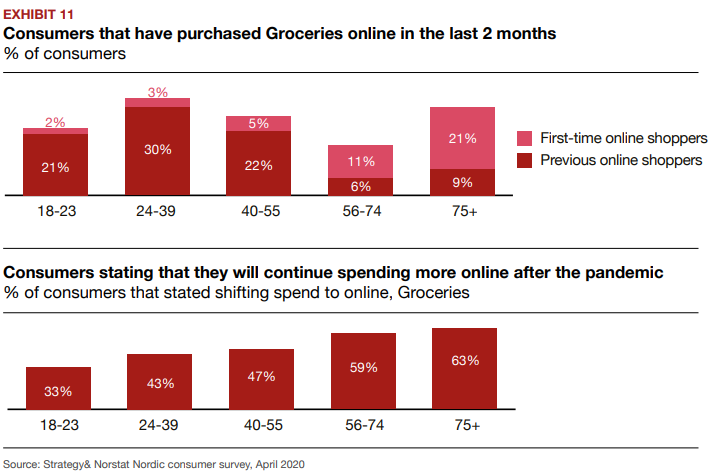

That’s a concept readily understood in the Nordic region, where e-commerce has been more prevalent than in other European countries. Data compiled by Eurostat, the European Union’s statistics agency, reveal that in 2019, 82% of Swedes and Norwegians, 84% of Danes, and 73% of Finns had purchased goods or services online within the previous year. That stacks up against an EU average of 63%.

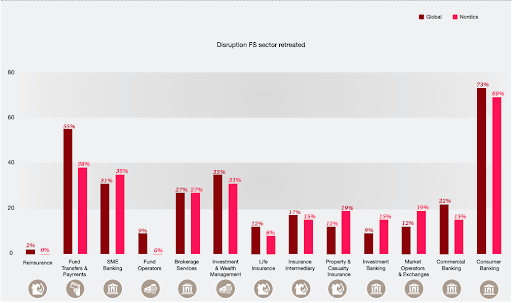

Which area within the financial sector is likely to be the most disrupted by FinTech?

According to the survey made by PWC, the financial industry identifies retail banking services as comprising the area experiencing the greatest risk of disruption within the next five years.

Approximately 70% of the respondents stated that consumer banking is most likely to face major changes as a result of the operations of FinTech companies. This view is predominant on both the global and Nordic levels, and the respondents’ comments do not vary significantly. The past fifteen years of retail banking have shown a strong willingness to implement change, and many predict that this trend will continue and at an even greater pace. Included as some of the main drivers are, of course, various efficiency gains, but other driving factors, such as technological advances, also need to be taken into account.

New technology has made it possible for smaller contenders to enter the retail market with relatively low thresholds and costs. Online consumer lending, online-based stock trading, peer-to-peer lending, and crowdfunding are examples of new operations coming to the fore during the past fifteen years where some of these companies have gained serious market shares in areas in which the banks were previously the sole actors.

The report clearly shows that the further you are from the consumer market, there is less chance to be disrupted due to FinTech. Consumer services are relatively simple, easy to package, and are not surrounded by the same massive number of regulations as with services targeted at such operations as investment banking, insurance, and asset management. With fewer regulations, development is considerably faster among consumer product companies.

Risk of business being lost to standalone FinTech companies

To a certain extent, traditional financial players have acted without sufficient insight and knowledge regarding this area, and this becomes obvious when approximately one-fifth of the respondents in the Nordic region (22%) reply either that they do not know whether any portion of their business will be lost to FinTech over the next five years or that they do not see any portion being lost to FinTech. Globally, an even greater number of respondents (one-third) respond in this manner. The complete and final story remains to be seen, but the financial graveyards around the world are full of “Kodak moments”.

Still, a fairly large percentage of the industry has sufficient insight to acknowledge the direction in which the wind is blowing. Both global and Nordic respondents indicate (37 % globally and 44 % in the Nordic countries) that they risk losing 1-20 % of their business to independent FinTech companies over the next five years. And the impact of FinTech in the Nordic region becomes even more evident when one considers that 19 percent replied that they risk losing between 41-61 % of their business over the next five years.

This is more than twice as high as in the global comparison and shows that various areas within the traditional financial industry take FinTech seriously, and also evidences that the strength of the drive behind these developments should not be underestimated.

Nordic Culture and Cashless Payments

Although market forces account for much of the shift toward cashless payments, cultural factors also help explain why countries in the Nordic region have been ahead of the curve compared to other countries.

The Nordic countries are famously high-trust societies, a fact which has heavily influenced the development of Nordic politics, business, and culture. It’s not difficult to understand, then, why Nordic populations have shown a greater willingness than their counterparts in lower-trust countries to make payments via credit card. The foundation of credit, in the final analysis, is trust.

This convergence of various economic, commercial, and cultural factors has led some analysts to forecast that Sweden could become the world’s first officially cashless society by 2023. Whether those predictions pan out remains to be seen – but for merchants in Nordic countries and beyond, the trendlines in the region offer important insights. Supporting e-wallets and digital payments is rapidly becoming a must, not merely a nice-to-have, and meeting customers where they are will mean coming to terms with a future in which cash continues to play a diminishing role.

Top 5 most influential Scandinavian fintech innovations

With countries like Sweden and Norway being committed to going completely cashless within the next 3-10 years, it is no surprise that Scandinavian countries have a lot to offer for those seeking to find new and exciting custom fintech solutions. Here is the list of the most influential, fintech start-ups that originate in Scandinavia and have already managed to establish themselves in both the regional market and within the EU.

Denmark - Tradeshift

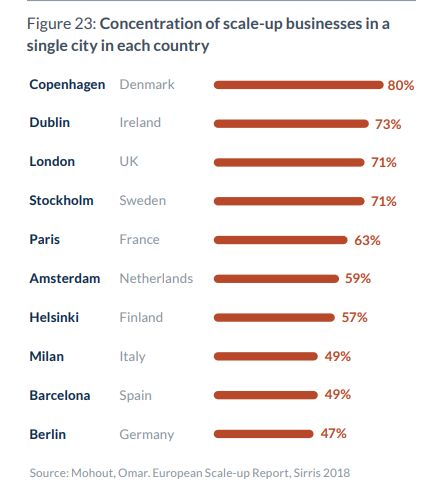

The Danish fintech startup scene has grown significantly over the last few years. With the government’s support, local entrepreneurs are encouraged to bring about innovation and contribute towards making Copenhagen the new international fintech hub.

In 2019, the country witnessed the rise of its own fintech unicorn - the Tradeshift. Tradeshift is a cloud-based platform that connects apps, marketplaces, and supply chain payment systems from all over the world. As of right now, the Tradeshift is working with over 300 companies worldwide and processes billions upon billions of USD worth of transactions.

Today, the Tradeshift is estimated at 1.1 billion USD, which makes it the pioneer fintech unicorn that originated in Denmark. The enormous success of this startup has inspired the Danish government to pay closer attention to the aspiring fintech entrepreneurs in the country and work towards establishing an environment where fintech innovations could flourish.

Norway - Vipps

In following Sweden’s lead, Norway is striving to create a cashless society. As of right now, the Norwegian market is flooded with various fintech solutions for mobile payments and online banking. Many of those are developed to cater to the needs of Norwegian citizens who wish to access the Norwegian mobile gaming sites that are otherwise banned in the country. The rapid growth of the variety of mobile payment service providers in Norway is unlikely to decrease in the near future, as the local government is constantly updating the regulations to limit gambling, and new fintech players appear to provide a way around them.

Sweden - Klarna

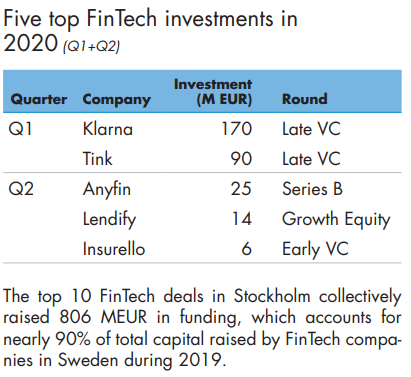

Sweden is the undoubtful leader of the Scandinavian region when it comes to fintech innovations. The country has an ambition to completely abandon the use of cash in the next three years and is, therefore, encouraging the vibrant fintech startup environment that could speed up this transformation. Sweden has long been known to produce some of Europe’s most impressive unicorns - and Klarna is one of them.

Klarna was first created 15 years ago in Stockholm and has now grown into the online bank that handles 40% of the total financial transactions carried out in Sweden. This fintech company acts as an agent between the buyer and the seller, and, when the latter claims the payments, Klarna proceeds it for the former. In September this year, Klarna was estimated at 10 billion USD, which made it Europe’s largest fintech unicorn of 2020.

Denmark - MobilePay

As the extensive usage of mobile payment systems has spread over the Scandinavian region, Danish banks have come together to create the country’s own mobile payment provider.

MobilePay was created in 2013 and offered swift and secure proceeding of transactions made via mobile phone. Today, more than 3 million people in Denmark use MobilePay services, however, the ambitions of this fintech company go beyond Denmark, MobilePay aims to become the leading Nordic mobile payment provider, however, so far, its attempt at gaining popularity in neighboring Norway failed, when the local banks chose to back up Klarna.

Sweden - Cyborg payment

The last Scandinavian innovation to discuss here might not be on the same scale of popularity and outreach as the earlier ones. However, it is arguably much more impressive due to its futuristic nature.

Cyborg payments, or otherwise referred to as radio frequency identification (RFID) chips, were originally developed by Biohax International and have since seen more than 6000 people inserting them into their bodies.

Final view at Nordics in fintech development

If this fintech innovation gains enough popularity, then the nature of how we proceed with our payments will change once and for all. If an individual can pay for the goods and services that they purchase with a simple wave of the hand, then a large chunk of the global fintech market will be demolished as its solutions will no longer be necessary.

It is yet unclear what the future of the global fintech market will look like, however, one can already see the pivotal role that the Scandinavian region will play in shaping it.

Observing and directly related to global fintech developments, we admire the achievement of the Nordic countries. It should be noted that the technologies used are also familiar to our dedicated development team. Therefore, if you have an idea for SaaS development and are missing only technically skilled team for its implementation, leave a request in the form below and we will be happy to assist you.