How to Build Own Trading Platform: Essential Steps to Get Started

Investing in stocks is fashionable and reliable, so the number of traders is growing daily. Existing applications do not cover a large audience's needs, so now is the perfect time to enter the market for new creative startups.

In this article, we reveal all the cards on how to develop a trading application and not screw it up. We tell you how to choose key features, how long the development will take, and what budget to expect.

Don't forget that finance is a serious subject, and to run a stock trading app, you need to obtain a license in all the countries where you plan to operate. We recommend seeking guidance from lawyers familiar with the region's regulations in which the platform will operate.

2 Types of Trading Platforms

There are two types of trading platforms:

- Commercial platforms. You can get it from the name that day traders and retail investors mostly use commercial platforms. They are quite user-friendly and include numerous helpful features, such as news feeds and charts, training for investors, and research.

- Prop trading platforms, in contrast to off-the-shelf solutions, are customized platforms developed by large brokerages to meet their unique needs and trading strategies.

Core Features of Trading Platform

Usually, large trading platforms have a large amount of functionality that has been developed over many years.

To launch your trading platform in the shortest possible time, you need to focus on the main functionality.

The main features of trading platforms are:

- User authorization

- KYC and Identity Verification

- Integration of clients` data with the CRM system.

- Integration with payment systems and multi-currency support

- Clients` area with personal information, trading history, dashboards and expenses

- Anti-fraud system

- API integration with third-party services

- 24\7 Support

- Notifications

Let's look at each point in more detail.

Pro Tip

We recommend starting with a microservice architecture. Quite often, you can connect ready-made solutions instead of developing them from scratch, which will save time and money at the MVP stage.

User Registration and Authentication

Registration on trading platforms usually takes place in two stages: client registration on the portal to familiarize themselves with the system interface and identity verification, which requires confirmation of personal data, such as ID card or passport, place of birth, address, etc.

Since financial information is sensitive, data privacy and security should be a top priority.

Consider consulting with experienced UX designers to ensure the page is comprehensive and visually manageable.

KYC and Identity Verification

Payments & Transactions

The service's most important feature is the ability to invest, that is, buy stocks or currencies. This feature includes charts with real-time updates of auction information, a company overview, growth figures, and other elements that help users make a purchasing decision.

The app also requires payment functionality to sell and buy stocks. To protect transactions and user privacy, we recommend using certified payment gateways to create an app as simple and popular as Robinhood.

User Profile

The profile page should contain all the necessary information about the user - name, photo, region, and application language settings.

Onboarding

It is the process of adaptation in the interface. Simply put, you need to explain how the application works to the user. If you do this immediately after registration, then users will not have time to get angry or upset, and they will not be able to find a certain section. Also, don't forget to add a "Skip" button for those who are not the first time.

Dashboards

These are smart reports that are generated in real-time. On this page, the user should see his balance, his shares, and their value. Yes, there will be a lot of charts, numbers, and graphs, plus the data will be constantly updated. Therefore, we recommend discussing the interface structure with the UX designer in advance so that your clients do not get confused in the jungle of numbers.

Robo-advisor

The results motivate users to invest more, so adding a page with personal statistics to the application is important. Some applications also generate automatic reports once a week or monthly, which are sent by a branded bot via messengers or in the application itself.

Administration Interface

There is a must-have to manage everything quickly at one click: customer requests, order enlisting and status indicators, personal accounts, access permission, managing transactions, pending and submitted orders, and more on the list. All of this allows decisions to be made in the shortest terms possible and ensures constant access to necessary information.

Push-Notifications

In most other applications, notifications are more of an annoyance for users, but this can help the user earn a staggering amount in trading platforms. Therefore, we advise you to implement push notifications when the stock price changes.

Process of Trading Software Development

Trading software development will require you to devote lots of time and effort. There are crucial stages to consider if you don’t want to fail and lose your money. We kindly ask you not to ignore them and read this section carefully.

Legalities to Consider

If you make a trading app from scratch, and you’re dealing with a sensitive matter such as user’s data, social security numbers, credit card credentials, you need to take care of the legal part in the first place. If you’re operating in the US, you have to meet the standards of the Securities and Exchange Commission. In Europe, trading platform developers monitor if their implementations meet the General Data Protection Regulation (GDPR) legal standards.

Other regulatory organizations and investor protection programs include:

- FINRA – Financial Industry Regulatory Authority

- SIPC – Securities Investor Protection Corporation

- NFA– National Futures Association

Discovery Phase

At this phase, we usually develop your MVP from scratch and fully take care of going live. You are supposed to get the whole product working without any troubles and can concentrate on finding investments and doing the first steps on the market.

Development Phase

MVP is launched. Now we shift into a part-time team to custom develop your project so can continue improving your online trading platform with any velocity you need implementing all changes and improvements required by the market.

Testing Phase

A release follows software engineers ' final rounds of testing and bug fixing. Apps are uploaded to the stores and from that moment, you need to keep your app up-to-date to decrease bugs caused by updates in third-party APIs and update your app with new features.

Maintenance Phase

At a certain point, you will have a “technical debt” and will require a lot of development to constantly scale, improve, and protect your trading system development software. We usually offer to create a dedicated team for you that is completely under your control.

Ardas Trading Expertise: Real-world Success Stories

In our practice, we had several cases of developing trading platforms. One of them is the complete system for an FX broker that handles all financial relations between a broker and its IBs organized in a multilevel hierarchy. Over 10 years on the market, presented in 12 countries, supporting over 15 languages, using more than 200 trade instruments of different kinds. It is a heavily loaded big data system that gives complete control and management over broker IBs and traders.

We were given the old system, which had many separate solutions, no integration, and many managing people supporting it. We transformed this system step by step, finding a balance between keeping it working, bugfixing, implementing new features, and implementing the automation that we required to scale the business.

After successfully transforming this solution into an automated system we entered a long-term support and evolution cycle and still update and tune this system according to customer requirements. We implemented the IB portal administration area, SalesForce integration, 53 payment methods, and many other online trading platform features that you can read about on the case page. The team that worked on these projects became a dedicated permanent team of our customers and today is an integral part of the whole business.

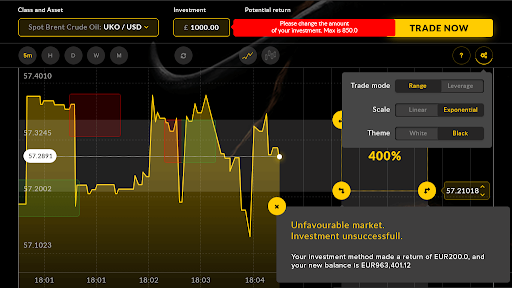

Another case concerns CFD trading instruments for FX brokers with full market control. A gamified high-load and high-speed instrument to trade currencies and commodities in a new manner. Extremely fast order processing. Being a SaaS tool gives each broker full control of the trading market and provides a fully organized real-time bidding process. A unique trading mechanism analyzes existing data and forecasts using the vector algorithm. Low latency application with full reports and features to control the broker's financial health.

We were required to create an option and CFD trading platform with an adaptation for smartphones, that provided a more engaging and gamified way to do short-term tradings and earn the money. The platform had to be designed as a B2B SaaS giving brokers a trading tool to sell it to their traders. It has been successfully tested with a few FX brokers in the UK.

This SaaS tool had several principle pivots while looking for a working business model. We took part in planning, designing, and implementing each of them. We shifted from B2B to B2C and finally implemented both. Trading tools and their UX were modified three times. We tried different payment strategies and finally changed the market from the EU to China, which caused many unexpected difficulties and obstacles.

We have been supporting this project since 2015. During this time, the team changed a few times because the project was on hold while looking for more investments. Despite all the organizational difficulties, we supported it whenever needed. After the new investor joined at the end of 2018, we adapted it to the Chinese market and launched it with several more features. We stayed with it during all the difficult post-MVP phase.

How Much Does It Cost To Develop A Trading Platform?

If you've been thinking about how to develop a trading app and succeed, then here's the only winning strategy - to create a user-friendly service. When you work with user money, there is no room for ambiguity - everything should be clear and understandable. The simpler the interface, the more people trust you and return to the app more often to buy and sell shares. That's why we recommend boldly investing in UX/UI design and checking your contractor's portfolio beforehand. Start with a Google search or check out Dribbble and Behance to see the developer's portfolio and style.

We know that development time is critical for dynamic markets like trading applications. If you decide to invest in UX / UI design and create a service with a beautiful and simple interface, then the rest of the development should be as fast as possible.

Good news! The average time to create a trading application at Ardas is six months. Also, you don't have to worry about the nativeness of the interface - React Native has a huge library of native UI elements, thanks to which elements in the application swipe and scroll just like in native development.

Judging by similar projects we've worked on, a service like Robinhood costs $85,000 or more for a full development cycle, including a prototype, UI/UX design, iOS and Android versions, testing, and so on.

Summing Up the Journey: Creating a Successful Investment Service

To create a successful investment service, use our step-by-step guide on how to develop a trading application. The first step is to define your niche. Who do you want to attract to the application and why? Where will you find your audience? Then, identify the key features that users will need, based on our list of must-haves and nice-to-haves. The fastest and easiest way to find out the details is to write to us directly and discuss the specific details of the future project. We will help design the interface, which will be simple and understandable for future young investors.

Frequently Asked Questions (FAQ)

How do you design a stock trading system?

The development process consists of 4 main stages, during which we implement from MVP to an advanced product with full functionality.

How does a trading platform work?

There are two types of trading platforms: prop platforms and commercial platforms. You can get it from the name that day traders and retail investors mostly use commercial platforms. They are quite user-friendly and include numerous helpful features, such as news feeds and charts, training for investors, and research. Prop platforms, on the other hand, are customized platforms developed by large brokerages to suit their specific requirements and trading style.

Are stock trading apps reliable?

Generation Y saw with their own eyes how political regimes collapsed, banks closed, money depreciated, and parents and grandparents lost all their savings. Therefore, young people prefer to invest in shares of large companies and start-ups - the risks are (relatively) less, and the income is greater.