Personalized Banking: The Future of Financial Services

Banks and other financial services institutions have been slow to join the personalization era.

Many are now trying to catch up as they realize that this marketing concept is not a passing trend. Additionally, as data privacy concerns shift, new technology is emerging designed to help organizations gather customer insights while maintaining privacy.

Now is the time for financial services industry marketers to lay the groundwork for a unified customer experience that considers more nuanced factors when making customer recommendations. Let’s look at the different ways organizations can implement personalization in banking.

What is Personalized Banking?

Personalization in banking is about delivering a valuable service or product based on personal experiences and historical customer data. It can help to build trust and, in turn, drive results and revenue by creating an end-to-end experience that integrates customer and operational data across all branches, apps, and call centers. In short, personalization can help organizations deliver solutions to their customers before they even realize they have a problem.

Personalization in finance isn’t an all-new trend – it’s a re-imagining of the business models that brought consumers to banks before the era of mass marketing. Decades ago, consumers would visit banks where they knew tellers on a first-name basis, as they were all active members of the same community - Today’s world is much more fragmented.

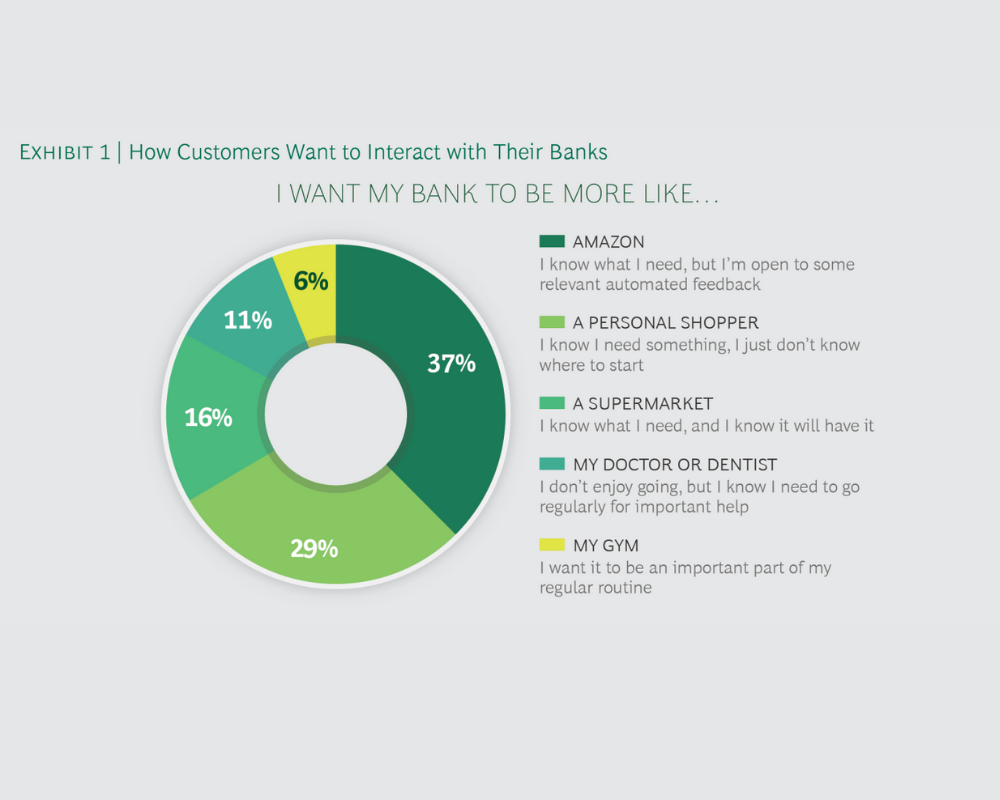

Although much of the discussion about personalization in banking focuses on marketing and the next-best offers, its true potential lies in transforming an organization’s customer interactions. Using data and analytics to anticipate individual needs, target segments of one, and build deep relationships that stand the test of time. To be sure, personalization in banking is not primarily about selling; and it’s about providing service, information, and advice, often daily or even several times a day. Unlike infrequent sales communications, such interactions form the crux of the customer’s banking experience. Yet many banks still tend to focus their personalization efforts on the sales arena.

Personalization at scale demands recursive learning, a single view of the customer, and a personalized curriculum (a sequence of interventions intended to change a customer’s behavior). These must be leveraged across all channels, products, and services.

Several consumer brands have shown the way forward. Starbucks, for example, uses a digital flywheel of rewards, partnerships, and technologies to develop relationships with millions of customers across its 7,000 stores in the US. Netflix uses personalization techniques to make movie and series recommendations.

Yet, while many financial institutions are conceptually on board and heavily investing, the Netflix of banking has to emerge. The main reason is that true end-to-end personalization requires developing new muscles—such as solid cross-channel offerings, cross-enterprise collaboration, a single view of the customer, and a new technology ecosystem—all of which are difficult to build.

Indeed, banks’ fragmented databases make it difficult to organize information and create 360-degree customer profiles. As a result, customers with different needs and propensities are sometimes offered the same products. Marketing strategies also tend to be stuck in the past, adhering to a calendar-based framework or featuring competing product lines that must jostle for virtual shelf space.

Moreover, legacy IT systems often cannot measure responses or recommend the next-best actions, while complex organization structures and silos undermine coherence and focus. As a result, although many banks are developing personalized marketing capabilities, they may be missing the more strategic opportunity for true differentiation.

Meanwhile, regulation is driving competition and increasing the threat of disintermediation. New rules such as the UK’s Open Banking initiative and the European Union’s Payment Services Directive 2 broaden access to customer data and create an opportunity for third parties to get closer to consolidated customer account information. Ultimately, if done well, personalization at scale can provide a direct route to lower customer churn rates and higher sales.

Conservatively speaking, it can lead to annual revenue uplifts of 10% for banks. In many ways, personalization at scale is a 21st-century approach to delivering what the banking industry lost many years ago. The ability to honestly know customers, anticipate their needs, engage in a rich dialogue about their financial lives, and foster loyalty that can last a lifetime.

Benefits of Personalization in Banking

Recently, the financial services market became much more transactional – it was no longer about the relationships with bank tellers. Instead, consumers were more concerned about who doesn’t charge maintenance fees and has the best rewards system for their credit cards.

In a race to cut costs, the personalized nature of financial services suffered. This is a huge missed opportunity.

Today’s customers are looking for valuable insight and advice from their banks. However, it’s difficult to give good financial advice when you don’t know a customer’s goals or priorities, something many banks can’t offer.

In addition to improvements in revenue, personalization in banking can enable several benefits, including:

- Increases in engagement and conversion rates

- Improved customer loyalty and retention

- Enhanced customer experience

- Consistent messaging across channels

- Stronger marketing ROI

For example, think of credit cards. Who doesn’t offer a credit card? Banks and major retailers compete for customers with steady incomes, solid payment histories, and frequent credit card use. This has caused a saturated market where banks are forced to become increasingly competitive – causing them to tighten their margins or take a gamble on customers with low FICO scores.

Not only that, but new entrants into the financial services industry have put a squeeze on existing companies. The most formidable new entrant is Amazon, with their Amazon Cash and Amazon Lending offerings that mirror prepaid debit cards and investment services. As of 2019, Amazon was lending over $1 billion per year and promised to continue growing and capitalizing on the market share that once belonged to traditional financial service organizations.

As a result of this competitive environment, financial services companies have started to build value by competing based on customer experience. By connecting with customers in a personalized, relevant way, banks can move away from the product obsession that sacrifices their margins, and towards a customer-centric focus that builds their brand value.

Types of Personalization

Generally speaking, there are three overarching types of personalization that banks and other financial services institutions can employ:

Prescriptive Personalization: The goal of prescriptive personalization is to anticipate a customer’s wants and needs based on historical data. Working within the context of the business’s goals, marketers can use this method to create rules and workflows that allow them to more easily manage users.

Real-Time Personalization: Real-time personalization relies on current, real-time data and historical data to create a personalized customer experience as it is happening. For example, marketing teams can leverage this personalization to make recommendations for customers as they are actively shopping on the site. This helps to drive both customer engagement and conversions.

Machine-Learning Personalization: This type of personalization makes use of intelligent machine-learning algorithms. With AI-driven automation, teams can make informed decisions about how to reach out to customers based on individual behavior.

Personalized Banking Implementation Process

Banks need to make revolutionary internal changes to scale personalization, driving it across customer prospecting, engagement, and retention stages. First, personalization at scale mandates breaking down channel and product silos and making the customer the center of attention. It further requires implementing fundamentally new working methods that require updating customer-centric objectives, creating customer incentives, retraining employees, hiring new talent, and building a new analytics and technology stack.

Scaling personalization is extremely challenging, and many companies do not move beyond proofs of concept and technology pilots. Companies that attempt an all-at-once step-change approach to personalization at scale typically do not succeed.

Building Custom Visualization Dashboards

Using a dashboard will help you to create banking personalization software. It is a comprehensive snapshot for visualizing the required data set at a micro level. The dashboard software gives an insightful view of data and helps to organize and improve in the relevant areas.

- Make decisions based on facts and on current data that is periodically refreshed daily;

- Make your data more valuable by allowing every organization member to gain insights that help them perform their job better;

- Get an overview of every important metric required for informed decision-making, including metrics and key performance measures from multiple data sources, markets and departments;

- Get insight into possible problem areas so stakeholders can handle challenges proactively.

Integration Algorithms in Existing Banking Core System

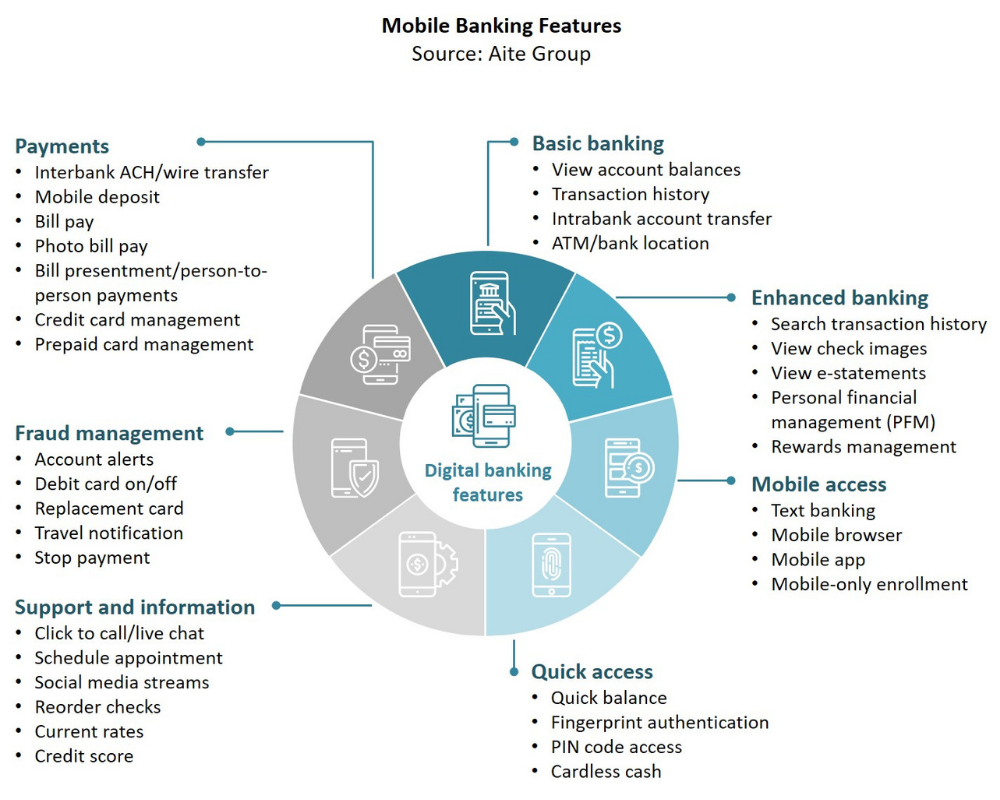

Orchestration, from data marshaling through channel management and delivery, is fundamental to achieving personalization at scale. Banks should focus on orchestrating a personalization stack of tools and resources.

The stack should have three core elements that form the foundation for personalization at scale in banking:

- Customer DNA. Banks’ systems should feed a single, enterprise-wide view of each customer—a view that dynamically reflects each customer at any given moment.

- A Personalized Curriculum. Customer offerings are tailored to a segment of one. They define desired customer behaviors and a strategy to incentivize those behaviors.

- An Analytics Engine and Recursive Learning. Using machine learning and systematic experimentation, banks enable flexibility and create customized offers and communications that evolve over time. The recursive learning capability required for personalization—no less than the ability to continuously learn about each individual customer and enhance that knowledge over time—constitutes a built-in advantage for those who leverage it first.

Of course, success will require more than analytics, technology, and next-best-action algorithms. Integrating personalization typically requires setting up an incubator outside of “business as usual” infused with new talent. It requires permitting the incubator to have a culture that differs from the organization and incentivizing staff behaviors typical of a digital organization: fact-based decision-making, accurate measurement, agility, and collaboration. Given the magnitude and speed of change in the industry, traditional change management approaches typically do not yield the necessary outcomes.

Data Collection From Different Sources

Leading banks are approaching personalization as a journey, developing a vision and rolling out tangible use cases and customer experiences in waves. This requires building the stack in an iterative, use case-driven way and training new orchestration muscles. Sophistication typically increases over time. Moreover, some banks are indeed learning and changing their cultures while building new infrastructure. Such an incremental approach helps ensure that implementation risks are managed and measurable impact is delivered along the way.

To start scaling personalization, we recommend the following six steps:

- Define a few flagship customer experiences that will help the bank achieve differentiation.

- Assess current personalization capabilities. Banks that have been investing in technology typically have assets and resources that they can tap.

- Assign senior executive ownership of personalization at scale.

- Instill a bias for execution. Many banks will likely have enough data and technology to get started and learn. Waiting for the full implementation of the personalization stack is a poor substitute for building and learning on the job.

- Scale iteratively in six-month waves. Each wave should deliver a more complete version of the target experience while building key elements of the stack.

- Ensure the strategy addresses the tradeoffs between short-term revenue and longer-term benefits and delivers the right mix.

Example Personalisation Delivery in Banking

Personalization needs to use several sources of consumer information to create a three-dimensional view of a single consumer.

Setting Up Better Lending Algorithms

Timing is everything. Financial services marketers shouldn’t promote products simply based on industry trends or sales quotas. Instead, use a marketing analytics platform to turn data from your CRM into a framework for smarter, more timely promotions.

First, marketers should identify which services customers most likely desire at each stage in the purchasing cycle. This information can be uncovered by analyzing person-level data with a marketing analytics platform. Then, these customers should be segmented based on their purchasing cycle. Here are a few suggestions:

- Awareness – At this point, consumers are learning more about your product offering. All outreach should focus on explaining how your product satisfies a need.

- Consideration – If a customer is interested in your product, they will usually see what your competitors offer before deciding. This is the time to explain what your service does differently, and provide customer testimonials.

- Decision – At this point, the customer is ready to purchase. They often just need a straightforward path to purchase, or perhaps a special offer to create a sense of urgency.

- Assessment of Choice – The buyer’s journey doesn’t end after they purchase, especially for service-based industries. The best financial institutions will regularly offer informative content to help people make the most of their offerings and avoid losing them to competitors.

In essence, banks need to understand that a first-time visitor is different from a customer that’s researching, which is different from the needs of long-term customers. Optimize your CTAs and content based on a consumer’s place in the purchasing cycle to encourage action. For example, a first-time customer should have a CTA button that says “How it Works” while a researching customer should see a button that says “Learn More.”

Customer Onboarding Personalization

The Royal Bank of Scotland recently introduced a powerful data-driven personalization campaign called “Personology”. The campaign is run by a powerful analytics team intended to reconnect the bank with its clients.

What is the end goal? Using detailed customer data, banks like RBS are using technology to understand what their customers will need according to their life stage. This puts them in the right space to proactively offer highly useful products.

According to research by BCG, for every $100 billion in assets owned by a bank, it can use personalized customer experiences to achieve as much as $300 million in revenue growth.

There has never been a bigger incentive to get into the personalization race. As to be expected, banks that are first movers will gain a competitive advantage over rivals.

As mentioned, personalization is about offering customers the right product at the right time so that the client feels they are not doing any of the work. The key is to build trust by actively boosting powerful interactions with customers.

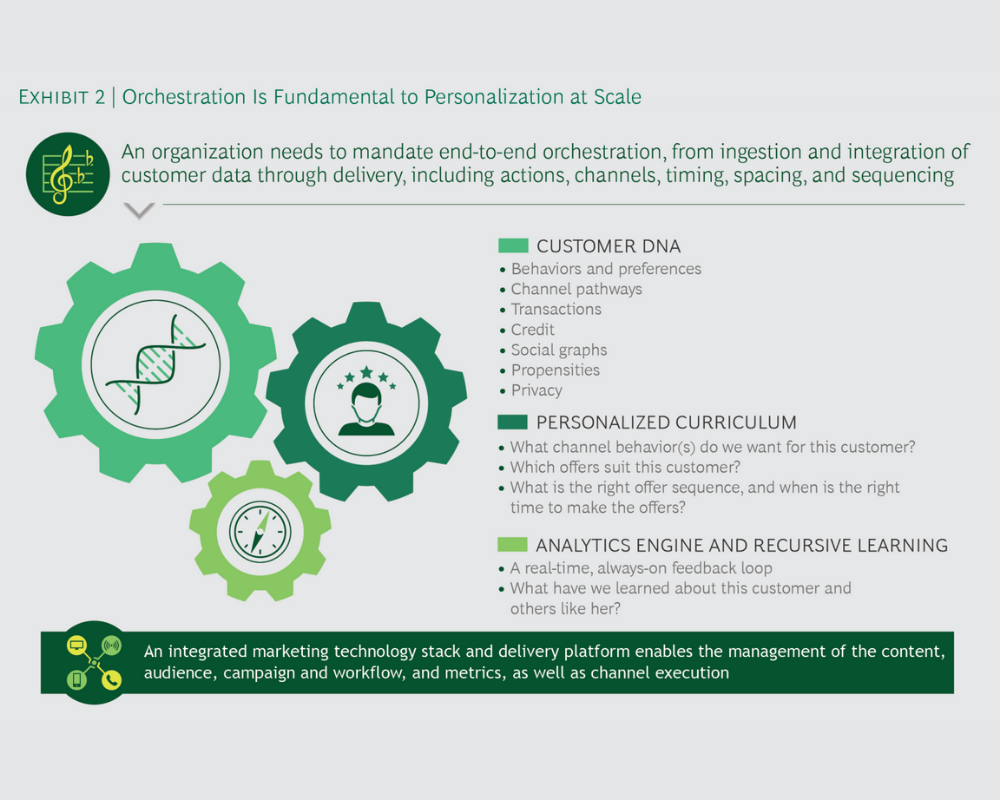

Digital interactions are at the heart of this journey. Users interact with their bank via their mobile app daily. This gives banks many opportunities to offer personalized offers relevant and meaningful to customers according to their life stage.

Driven Content Creation

Data-driven content creation is becoming integral to marketing strategies, and the financial services industry is no exception. However, creating content isn’t as simple as making a few standardized customer resources. Content isn’t one-size-fits-all, even if some pieces appeal to broad demographics. Instead, try to optimize your blogs and resources based on small customer segments, and then advertise them to consumers that have the most interest in that content. Here are two primary ways to segment customers when creating targeted content:

- Dividing based on use – Is this particular consumer using your credit card? Or are they looking for home financing? Marketers need to identify which products customers use and show them content that aligns with the products they value.

- Dividing based on interest – The average American wouldn’t be interested in a flight-miles credit card. However, somebody who often travels for work or leisure would be very interested in a credit card that offers flight miles. So, any promotional blog content for this credit card should be pointed toward frequent fliers. Financial services marketers need to leverage customer data to identify the most responsive customer segments accurately.

Targeting blog content this way can also help strengthen customer relationships. If you send email updates when your team posts to the blog, you can ensure that clients only receive content that is relevant to them. This will make your updates more personalized and show that your organization cares about your individual consumer’s interests.

To create content that resonates with consumers, it’s best to link attitudinal survey responses to person-level sales data. This will help your organization find weak areas where more content is needed to resonate with a specific demographic or target audience.

Sum Up

Personalized banking is becoming a reality, with leading banks seeking to transform how they interact with customers. Banks that achieve personalization at scale stand to make significant performance gains and create a powerful barrier to disintermediation. Those institutions that seize the challenge most rapidly and deliver true end-to-end personalization will create a significant advantage over their competitors.

But time is of the essence. For those that have not already embarked on the journey, the time to act is now. Our dedicated team is ready to assist you in developing the most accurate personalized banking solutions.