Cloud-Based Digital Banking: Advantages, Risks and Implementation

Even though cloud solutions are not a new technology, there are quite a few skeptics who still don't trust this technology. Digital banking solutions are no exception.

Cloud-based digital banking solutions have brought enormous benefits to financial institutions, allowing them to reduce high infrastructure costs and provide scalability and flexibility. While the benefits seem very tangible, fintech companies see several potential threats. One of the most common is the level of security and the technological maturity of cloud solutions. As a result, fintech companies are wary of taking the first step towards cloud connectivity.

We analyzed the concerns our customers face when they think about cloud technologies' reliability and compiled a list of parameters for the reliability of a cloud digital banking solution.

What is Cloud-Based Banking?

This is an external system for the bank to provide remote services for its customers. Any retail bank, by connecting to a cloud service, allows its customers to receive financial services remotely. All the end-user needs is a login and password to access the service and a device to access the Internet. How can a bank choose between implementing the RBS system within the bank and using an external service? Important parameters for the analysis will be the bank's goals for the medium and long term, the economics of implementing and maintaining the remote banking system, the availability and opportunities for the formation and development of the necessary competencies on the side of the bank, as well as many other aspects.

Benefits of the Cloud for Banking

The advent of COVID-19 has made the scalability, resilience, flexibility and availability of public clouds much more important to banks than ever. During the pandemic, bankers could compare the performance of cloud technologies (both public and private) with legacy technologies.

The opportunities resulting from the cloud transition will be revolutionary for individual banks and the industry.

Cost Savings

According to IDC Financial Insights, the world's largest banks in 2019 saved about $15 billion from implementing cloud technologies and reduced IT infrastructure costs by 25%.

Flexibility

One of the significant advantages of cloud solutions is that a microservices architecture supports them. Applications and solutions run on flexible cloud infrastructure, such as serverless infrastructure. This allows you to develop a geo-distributed architecture, smoothly distribute the load on servers and control the distribution of service resources.

The microservices infrastructure allows the fintech to easily and quickly make any additional changes or developments in the future without affecting other parts of the system. But creating such an architecture for new, small or medium-sized companies will be costly and will likely never pay off. In addition, highly skilled IT staff are required to design and build this ecosystem.

Fraud Detection

Along with a secure server configuration, when evaluating cloud service providers for Core Banking software, experience with financial sector regulators should be considered, namely platform compliance with industry guidelines, legislation, and verified platform use by regulators.

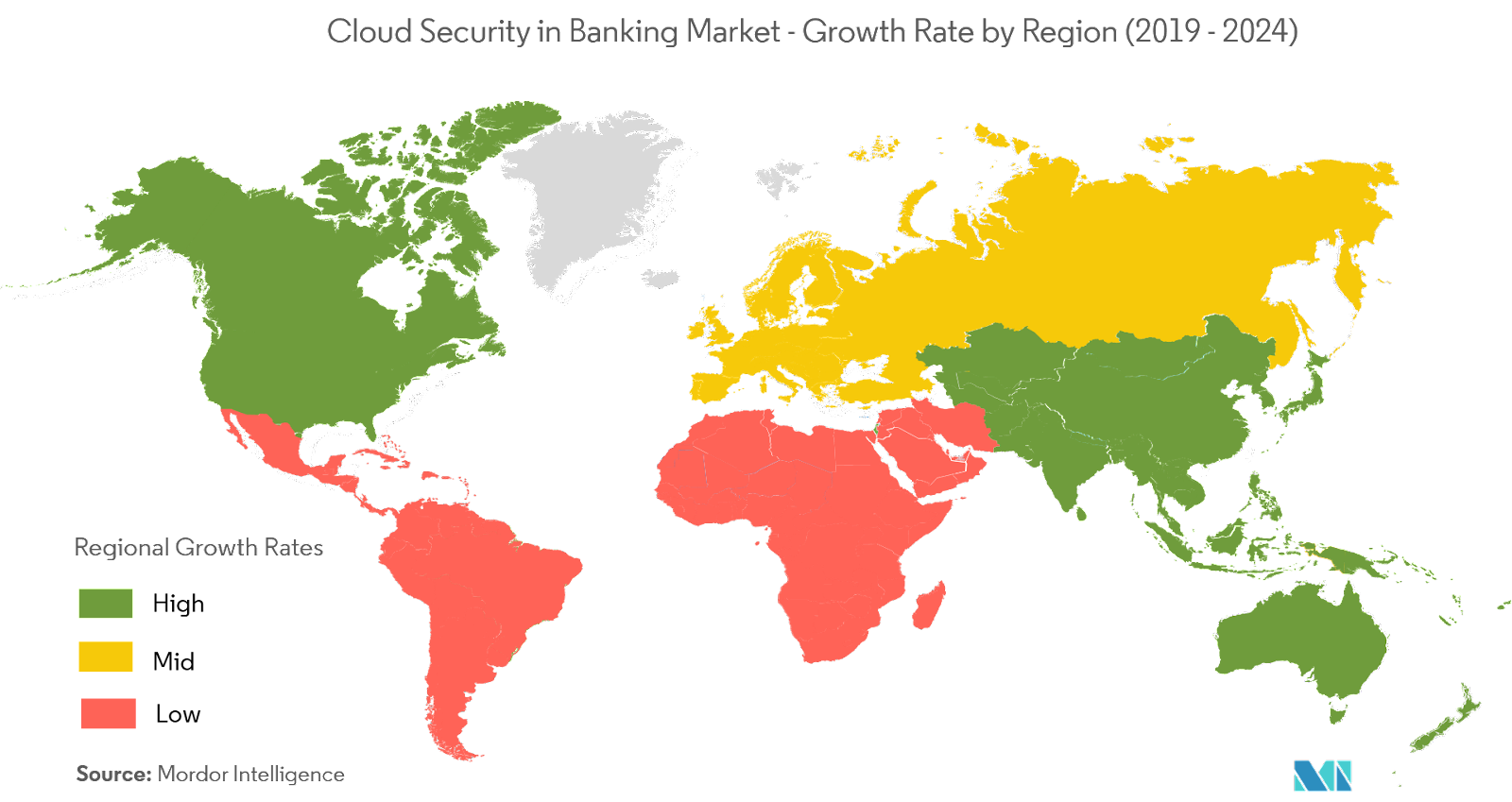

Many off-the-shelf cloud banking platforms are being developed to meet regional requirements (such as the European Union). In fact, any new platform must be reviewed and validated by financial services regulators. In addition, regulators prescribe requirements for risk management, IT systems and information security management, outsourcing requirements for external cloud service providers, etc.

Higher Level of Disaster Recovery

To securely transfer data in the cloud and prevent unauthorized access, it is important to ensure high security when managing servers and networks. Regulations require fintech and banks to be aware of the physical location of their data and how that data is shared in the cloud. Today's data centers hold many widely recognized IT security certifications and their systems are tested against the most stringent industry standards.

For example, the Azure platform, which powers our cloud banking solutions, has built a solid foundation based on world-class global infrastructure. It complies with international, regional or industry standards and has many certifications, such as global fintech services standards: Payment Card Industry Data Security Standards (PCI DSS), various ISO standards, Data Protection Directive (GDPR), etc.

In addition to global standards, the platform complies with the regulatory standards of various jurisdictions, such as EBA (EU), AFM and DNB (Netherlands), AMF and ACPR (France), FCA and PRA (UK), FINMA (Switzerland), KNF (Poland), MAS and ABS (Singapore), NBB and FSMA (Belgium) and others.

Typically, new fintech companies do not have sufficient IT resources, knowledge, and experience to build the infrastructure of the same level as the providers of ready-made solutions. But even if there is, it will be too expensive and unprofitable at first.

Easier Analytics

Threat intelligence, intrusion detection systems (IDS) and intrusion prevention systems (IPS) are the backbones of cloud security and reliability in cloud banking. Threat intelligence IDS provides the necessary features to detect and prevent any attacks automatically. An IPS is created primarily to detect and prevent an attack or potential incident.

Summing up all the above parameters, we can see that cloud banking ready-made solutions are reliable and there should be no doubt about the security. Remember that even with the highest security standards for cloud solutions, fintech companies must provide the highest level of protection for application personnel to mitigate malicious attacks and internal security breaches.

Green IT

Green Banking is a term that refers to the promotion of environmentally friendly practices that aid Banks and their clients in identifying and managing environmental risks as well as reducing their carbon footprint and related socially adverse actions.

Risks Involved in Cloud-Based Banking

Like any third-party service, the cloud means banks must relinquish control over their operational, procedural, security and privacy systems. Cloud providers may also use contractors themselves, exacerbating supplier risk.

Security

It has remained a hot topic within cloud computing, although the consensus is that previous fears may have been blown out of proportion. Arguably, the major players in the cloud space - Google, Amazon, and Microsoft - have encryption measures and security protocols that rival or even surpass what FIs can implement internally.

Regulatory and Compliance

In 2016, the Financial Conduct Authority (FCA) published new guidelines for cloud adoption within the sector. The regulator argued that nothing stops banks from implementing cloud services, including public cloud, in a way that complies with the organization's rules.

The European Central Bank (ECB) also specifically warned fintech banks about the hazards of the cloud in a September 2017 report. Cyber security and outsourcing risks are particular problems for fintech businesses because of their technology-driven core, which means they are likely to adopt the cloud at an early stage of maturity.

But a recent Financial Times (FT) report hinted that greater scrutiny could still be on the horizon. Not only is the Bank of England considering testing FIs' resilience to cloud threats later this year, but also the institution's Prudential Regulation Authority may be publishing updated guidance on the subject in 2018. These instructions could precede new regulations for the cloud in finance.

Data Migration

The CIF found that nine in ten businesses have problems migrating to the cloud. The average migration project takes 15 months, but larger established banks can expect far weightier timelines.

Human Error

Of course, one should not exclude the risks associated with the human factor. In this case, your main task is ensuring that the team you entrust to implement the transition to the cloud is reliable and competent enough.

Cloud Service Models for Banks

In the description of cloud solutions and services, you can find quite often such abbreviations as IaaS, PaaS, and SaaS. Even in our articles and service pages, the phrase "SaaS software development" occurs constantly. However, not all of our clients understand the meaning of these terms and their business value. Let's look at how all these aaS differ, how they work, and what capabilities they provide to cloud users.

All three are cloud computing services and are designed to address the specific requirements of different B2B companies. You, for example, need those cloud business and productivity solutions offered by vendors as SaaS to keep your young company running from day to day and help it grow. Other companies, such as those that develop software, may require a cloud-based platform that they can use to create custom apps. There’s PaaS for this. Others may still need whole cloud infrastructure resources to build and manage their network, servers, apps, operating systems, and data storage. IaaS answers this particular need.

Any of the above services are designed to remove a certain part of the time and financial costs for the deployment and support of your IT service (be it a business card site, a 1C server in the cloud, or a large corporate project). The whole difference lies in how much of the worries you leave for yourself, and what you leave to the service provider's management.

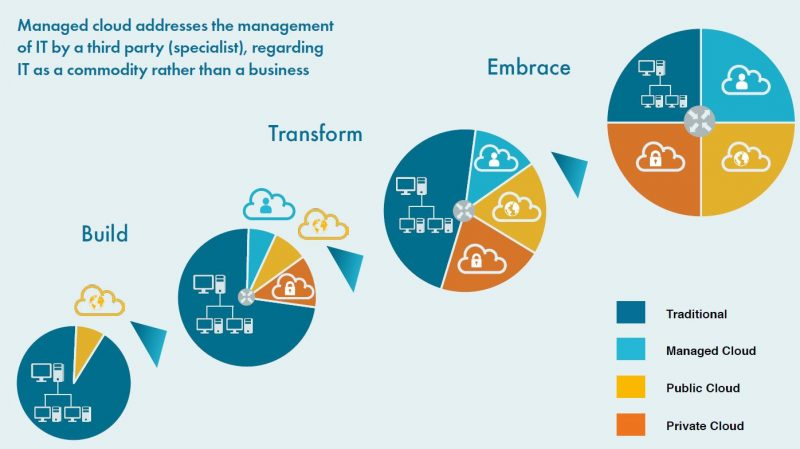

Cloud Deployment Models

Cloud deployment offers a great choice in choosing the management required and level of security and hence is suitable for almost any business. Although no magic bullet can meet all the requirements, cloud computing offers several advantages to financial institutions.

Cloud deployment has two different approaches based on the management of responsibility for deploying different solutions. These are:

- The cloud is deployed by a third party, used in the community, public or private cloud model.

- The cloud is deployed by a single entity, as is used in the private cloud model.

SaaS cloud deployment can be used either in the public cloud model or private cloud model. However, when a singular entity manages a hybrid cloud model, the SaaS deployment can also be used. Virtual private clouds function in the same way as private clouds do but in a public space. This means that only trusted entities can access the cloud. These virtual private clouds also use SaaS deployment.

Step-by-Step Guide to Cloud Migration

The migration process may look complicated, but the gradual step-by-step movement helps to make it smooth. So, let's see what stages it includes.

Choosing Service Providers

At this stage, you need to understand the purpose and objectives of moving to the cloud. The project's further implementation depends on how detailed you write down the expectations. Then decide who will manage the process and be responsible for it.

Software Architecture

Conduct a commercial and technical assessment of IT, production and business resources. Based on this analysis, the scope and timing of migration, risks, potential costs and benefits will be determined. You will understand which applications are adapted for migration, and which components are suitable for it, and which require reengineering. Do not try to migrate everything to the cloud at once.

It is logical to store standard business applications in the cloud, but unique solutions based on the company's intellectual property and which are a key factor in competitive advantage are best stored where you can fully control them - in your own infrastructure.

Cloud Data Migration

Conduct a commercial and technical assessment of IT, production and business resources. Based on this analysis, the scope and timing of migration, risks, potential costs and benefits will be determined. You will understand which applications are adapted to migration, and which components are suitable for it, and which require reengineering.

Don't try to move everything to the cloud all at once. It is logical to store standard business applications in the cloud, but unique solutions based on the company's intellectual property and which are a key factor in competitive advantage are best stored where you can fully control them - in your own infrastructure.

Synchronize Replications

Even with a clear plan and roadmap, the migration process will require a temporary shutdown of internal servers. This will inevitably affect the health of applications and potentially cause problems for clients, especially if the shutdown is not planned. Downtime can be disastrous for application performance—and thus customer loyalty—if not supported by a proper disaster recovery plan.

Migrate Business Intelligence

Migration, depending on the type of organization and the complexity of the infrastructure, can be divided into two types recommended for different enterprises:

- Gradual migration. First, non-critical services are transferred (most often these are test environments and using virtual machines), and after them, everything else. Partial migration is suitable for large companies with many applications and an extensive infrastructure.

- Full migration. The full migration is the transfer of the entire infrastructure over a certain period of time. The full migration suits small and medium-sized businesses with a simpler IT structure.

The types of migration can also be divided into those that require shutting down virtual machines and those that do not.

Cloud-based Core Banking vs On-Premise Software

Cloud RBS is usually presented as a kind of rental of banking services with a limited set of functions for the initial period. But the standard configuration of such a solution can be supplemented in full accordance with the wishes of the client in the shortest possible time, and the profitability can be higher than when developing and implementing your own project.

| Category | Cloud-Based Core Banking | On-Premise Software |

| Infrastructure | Hosted remotely by a third-party cloud service provider | Hosted on the bank's servers and infrastructure |

| Maintenance and Upgrades | Managed by the cloud service provider | Managed by the bank's IT staff |

| Security | Responsibility shared between bank and cloud service provider | Responsibility lies solely with the bank |

| Scalability and Flexibility | Highly scalable and flexible | Scalability and flexibility can be limited |

| Cost | Generally more cost-effective due to the pay-as-you-go model | Can be more expensive due to upfront infrastructure costs |

| Reliability | Dependent on cloud service provider | Dependent on bank's IT staff |

| Customization and Control | Limited customization options, but provides flexibility to switch to different software | Full customization and control over software and data |

Each approach has pros and cons, and the decision to choose one over the other depends on the bank's specific needs and priorities. Cloud-based core banking may be more suitable for smaller banks or banks with limited IT resources, while on-premise software may be more appropriate for larger banks or banks with specific security or compliance requirements.

Ultimately, both approaches can provide robust banking technology solutions, and the choice depends on the bank's circumstances.

Final Thoughts

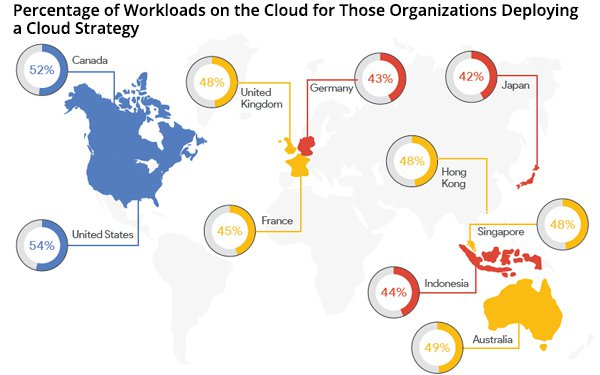

As a software provider for both banks and cloud companies in various regions of the world, we can advise you to first focus on the needs of current and prospective customers. Understanding the client profile, tasks, and expectations from the service will largely allow you to make the right choice. Our current projects show how strongly end-user needs differ in different locations and how the perception of interface design and usage patterns differ. In our opinion, the end-user's satisfaction is the most important task of any business. At least, we try to build our work on this principle.

F.A.Q.

What are the examples of digital banking?

The most prominent examples are mobile apps, e-wallet solutions, and personal finance management (PFM) tools (see figure 2). In particular, mobile banking and PFM are well received by consumers, with download rates reaching 60 percent of the customer base in most regions.

Which cloud model is best suited for banks?

Banks can start small with less critical applications such as CRM and then move on to core business applications. Consistent system performance. Confidentiality requirements. Therefore, private cloud-based operating models are a better first choice than public or hybrid clouds.

How much does it cost to implement the cloud-based banking core?

It depends on business goals and functional content. The starting price of MVP development will cost from $70,000.

| Hosted remotely by third-party cloud service provider |