How Much Does a SaaS MVP Development Cost?

If you have an idea for a great service or application that solves a user problem, don't rush to invest in developing a fully functional product and get ready for months of hard work behind closed doors.

It will be much more efficient to answer the question, "Do users need this product?" MVP will help you with this.

However, at this stage, there is often a misunderstanding between start-ups and the companies they trust to develop.

According to Ardas's experience with more than 70 SaaS projects in 19 years, the price of SaaS MVP development starts from $50.000 for basic startup and around $12-13.000 for micro-SaaS.

In this article, we tried to explain all the nuances that can affect development costs and how you can cut costs on MVP development.

What Is an MVP for SaaS?

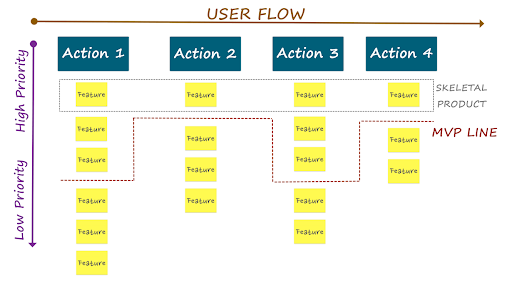

A SaaS MVP, or Software as a Service Minimum Viable Product, is an initial version of a software product that includes only essential features yet delivers significant value to users. It is a foundation for idea validation, allowing startups to quickly launch their product, gauge user interest, and minimize initial costs. Once launched, the SaaS MVP enables iterative development, incorporating user feedback, adding features, and adapting to market demands for continued growth and success.

Team Composition for SaaS MVP Development

The team's composition affects the development cost because each specialist has his own rate. The team for developing Saas projects is often the same:

- Manager/analyst (100%) or two people 50% each;

- Front-end developer (100% -200%);

- Backend developer (100% -200%);

- UI / UX designer (30%);

- DevOps (30%);

- QA (100%) or one for frontend + one for backend (50% for each).

The percentage indicates the workload of specialists at the time of project development.

SaaS MVP Development Cost Based On Team Model

Undoubtedly, creating an MVP is cheaper than developing a full-fledged mobile application. That's why it makes sense to invest in this product - to save money by learning everything there is to know about the market and target users. This allows you to refine the idea to create the perfect app later.

No one can predict exactly how much your MVP will cost. Its cost is always influenced by many factors: the vision of the product owner, the number of functions, the technology used, but most importantly, what level of team you will choose for this work.

In-House Team

In-house development is all about having your own full-time team that is located in your office and directly managed by you. Moreover, the whole idea is that you don’t just hire them for specific projects but for your company in general. This puts you in an “employer-employee” rather than a “client-contractor” relationship; however, that usually comes together with additional expenses.

Outsourcing Team

Outsourcing is usually cheaper since you hire an already-settled team from abroad. Moreover, you also save time by not having to build such a team from scratch on your own.

For a Startup built around a Mobile or Web app and depends a lot on it, having its In-House team may be essential. However, outsourcing is quite a good interim solution for MVP development while you’re creating your In-House team. For this kind of process, you may even consider outsourcing a CTO!

Freelancers

They also fall under the same category as remote teams. Thus, the factors that define MVP costs when working with freelancers are their hourly rate and expenses related to third-party services.

| Team Type | Approximate Average Costs |

| In-House | ~$140,000-150,000 |

| Local Agency | ~$180,000-190,000 |

| Freelancers | ~$50,000-55,000 |

| Outsourcing Agency | ~$70,000-80,000 |

Please note

The digital industry is fast-paced and constantly changing. Accordingly, the prices we indicated are not final but only approximate. Our specialists will help determine the development cost of your own SaaS MVP.

Team Location

The country where the developers are located also seriously affects the cost of developing SaaS software. At the same time, a developer from Eastern Europe may have a lower rate than a specialist of the same level and technical skills in the USA.

Let's look at the approximate numbers.

| Region | Approximate Cost |

| USA | ~$190,000-200,000 |

| Australia | ~$110,000-130,000 |

| UK | ~$150,000-160,000 |

| Western Europe | ~$100,000-110,000 |

| Eastern Europe | ~$70,000-100,000 |

SaaS Complexity

The complexity of a SaaS product is a concept that includes a set of functions and the complexity of their implementation, user roles, infrastructure, architecture, third-party integrations, security measures, etc.

For example, a simple SaaS e-commerce application with a ready-made integrated payment gateway will cost less than an entire customer service system with functionality for processing invoices, monitoring sellers' performance, etc.

The more complex the platform, the more time and resources it needs to develop and the higher its price. There are four main options.

| Complexity Type | Approximate Cost |

| Micro | ~$13,000-15,000 |

| Basic | ~$35,000-40,000 |

| Average | ~$60.000-65,000 |

| Complex | ~$130,000-150,000 |

Please note

The cost we discuss is only an APPROXIMATE, as different products and industries require the involvement of different technologies, specialists and different integrations. Therefore, the exact development price can be determined only after a free consultation with specialists.

SaaS Type

The type of software also affects SaaS MVP development cost. Some types of programs require the implementation of more complex functionality and the involvement of highly specialized specialists; they have a more complex infrastructure and require more protection and cyber security efforts.

Therefore, approximate costs may vary by product type.

| Software Type | Average Cost |

| CRM | ~$60,000-65,000 |

| Accounting software | ~$75,000-80,000 |

| Marketing and sales software | ~$70,000-72,000 |

| ERP | ~$100,000-120,000 |

Average Time to Develop a Minimum Viable Product for SaaS

It usually takes 3-6 months. This period is more of a business reason than a technical one since no matter how complex the project is technical, its implementation cannot be delayed.

If the release is delayed and you cannot offer the client anything in the first 6 months, then there are two options: either you have taken on a very difficult task that requires completely different funding, or you have not correctly estimated the average cost to develop a Minimum Viable Product for SaaS.

Save on MVP Development Costs with SaaSBuilder

With SaaSBuilder, you can save time and money by leveraging its customizable templates and pre-built integrations. See how SaaSBuilder can help you launch your MVP faster and more affordably.

MVP Development Stages And Costs Involved

The cost of developing a minimum viable product can vary from zero to infinity - the final figure largely depends on the budget and complexity of the project.

The price of an MVP is largely determined by the decisions made at the start. So, for example, you can:

- Ask for help from fellow developers or assemble an in-house team (recruit developers, designers, testers).

- You can create a simple landing page or build a technically complex solution with many different features (some believe that at the MVP stage, it is critical to include everything within the budget).

The total development cost will vary greatly depending on the scenario you choose. From all this, we can conclude that there is no such thing as "the exact cost of an MVP".

Proof of Concept\ Research Stage

Proof of concept, or proof of principle, is typically an internal project that helps you to verify that your theory has the potential for real-world application. However, we’ve taken proofs of concept to market in a controlled test environment for clients, particularly when developing B2E applications. In testing your proof concept, you can determine two important things: a) whether people need your product and b) whether you have the capabilities to build it.

A minimum viable product, on the other hand, helps you learn how to build that product most sustainably and with the least amount of effort. Through marketplace testing, you’ll learn how people react to different iterations of your product and its potential features. The MVP process enables you to determine precisely what it is your customers want, so you can add only those features needed to make it marketable.

Prototyping

A software prototype is exactly what you would expect from the name. It is an initial mockup of a software product to demonstrate the feasibility of a feature.

The level of detail and useability of the prototype can vary. It could be a quick sketch on paper, a digital demonstration of how a single feature would work, or a full working model of the app.

Software prototyping has become increasingly popular as an invaluable way for developers to understand clients' needs and for clients to demonstrate to investors and clients what they will be offering.

Depending on the specification of the prototype, it can be clickable and “work”. However, it is not a working product, simply a demonstration of what it will look like.

Plus, the prototype might differ greatly from the final product, but that’s to be expected. This is because the prototype is meant to gather data, not to be a fully-fledged application.

After the prototype is tested and feedback is gathered, the software will then go through the next stages of development to be improved into the final product.

Design Stage

Once the client gives prototypes a ‘go’, it’s time to dress them up. To do so, designers need to think through the entire UI part with the ‘rough’ MVP design concept in mind (you remember about those 1-2 app screens, don’t you?).

To make MVP designs stand out, designers add colors, fonts, animations, logos, and all necessary brand-related elements. Without a sexy look, it’s hardly possible to hook users—no matter how helpful or easy-to-use your product is.

Development Stage

Once you’ve determined key features and learned about market needs, you can assemble your MVP. Remember that a prototype does not mean bad or average quality. Your product still has to satisfy the user. Thus, it has to be easy to use, appealing, and, most importantly, fit the main user needs.

Testing

Everything is part of a process: first, define the scope of work, followed by moving the product to the development stage. After product development is completed, the product needs to be tested. Quality Assurance engineers, who work to improve the quality of the product (even if the product is not released), conduct the first testing stage.

After launching the MVP, the business must review everything thoroughly. That is, it must collect its clients' reactions to the release. With their feedback, it can determine the acceptability and competitiveness of its product in the market.

Why Can the Costs of Building a SaaS MVP Be Way Different?

Nevertheless, there is a situation when the price will differ significantly from the calculations provided above.

Budget Planning to Build a SaaS MVP Could Be Much Less

Clients often confuse goals: to make a profit center and to do something to get an investment in a profit center - these are two big differences! You do not need an MVP to get an investment, but you need a demo for the investor, as it is usually called the POC.

When we analyze the project, we always discuss the goals with the founder, helping him better define the strategy. If you do not need an MVP but need a POC to show the investor or start pre-sales, this is significantly less work. According to Ardas's experience, you can stick within 15k-30k.

Be Careful Not to Have Much Expensive SaaS MVP Development Cost

If you want a lot at once, then this is not right and the MVP needs to be cut and most often, we are faced with this situation. Customers often want more, it seems to them that the functionality cannot be removed, they worry that this will make the product bad, but this is not so. We always help to build the MVP without compromising the product, focused on the fastest entry to the market.

Top 5 Factors When Your MVP Has to Be Cut

Implementation period

As we explained, the average implementation period is 3-6 months. Hardly it will work properly within less time. But, a client usually wants to add something else, which takes longer. That can be done later after MVP is launched.

Range of functionality

Clients are often not ready to downgrade their MVP because they believe the project will not survive without them. It's a delusion. In the first release, only the most key features are enough to distinguish your project from all the others.

Administrative functionality

Do not rush to develop web applications for the project staff themselves that will help manage the project. As a rule, this will be needed after the first customers, and at the initial stage, you only need what can sell your product.

Work on security

Security is an extremely important part of development, but at the initial stage, no one will try to break your project. Therefore, you can reduce your efforts and deal with this issue later.

Working on perspectives

It is not worth spending money at this stage on those functions that pay off in the long term. Accordingly, it will be possible to work on the quality of the code, data storage, etc.

How Much Does MVP for a SaaS Cost in Total

- team productivity: 4.6 - 6.6 full-time person per month, real hours per month 140 (which is done by one person because we usually subtract from the standard 176 hours the time for vacation, sick leave, self-education, etc.), i.e., total 644 - 924 hours per month;

- team price per month: 25,760 - 36,960;

- multiply by a period of 3-6 months: 77.280 - 221.760.

However, according to our experience of more than 70 SaaS projects in 19 years, the price is usually $50k—$150k. Please note that we calculate the cost based on the fact that our expert costs $50 per hour on average. Of course, some companies can offer a lower price, but they can hardly promise a quality guarantee.

What we have described above also includes product design, i.e., price for development from scratch, starting from the list of requirements.

However, if you still have doubts and feel that your project may not fit the standard we described above, leave your contacts, and we will make a rough estimate for free.

Please note

$70k is an approximate minimum cost, which is irrelevant for all products. You can get exact numbers after a free consultation

SaaS MVP Cost Example

Ardas has its own product that became #1 in the world.

Thanks to our engagement and business analysis we spent 1/3 of the budget the customer aimed to spend, letting it grow fast and investing more in marketing. The best email template builder used by Amazon, McDonald's, Oracle, CocaCola, Airbnb, Uber, HP, and Cisco. However, the email template visual builder with AMP support was used to go through the MVP development stage itself.

We started in 2016 with an idea and built a very detailed MVP plan, mostly thinking about how to compete in a very busy market. We investigated all the disadvantages of existing builders and designed a WYSIWYG builder that saves 50% more time than others.

The MVP development took us about 4 months and we released the email template builder that included 5 basic blocks: picture, text, button, video, and HTML. Such a development cost us approximately 50,000 USD.

Later, in 2019, we supported AMP language by Google for dynamic emails and became one of the few builders with the best AMP support.

Final Thoughts on SaaS MVP Development Pricing

Remember that the first version of your product or project should be as simple as possible (only the basic functionality). The deeper you go into development, the higher the cost of making a mistake. No need to be brought up to perfection. The later you get user feedback, the more expensive the error will be.

A startup is a set of technologies and tasks applied to outsourcing companies. Sometimes, it is more complicated, sometimes simpler, but often, in essence, it comes down to either an online store or CRM, ERP, aggregators, or messengers (that is, modularity).

All the innovation and complexity of the cost of MVP SaaS development will rest on your roadmap, use cases, and business process automation. Therefore, the ideal option at this stage is not to assemble your team but to trust those who already have a "hand full".

We advise you to consider Ardas if you are looking for an ideal outsourcing team. It is a large source of specialists and has an optimal price and quality ratio. Therefore, if you are looking for an objective assessment of your project at the MVP stage, we will gladly consult you and help you.