How To Build a Peer-to-Peer Lending Business Platform

Peer-to-peer (P2P) lending has become a popular alternative to traditional banking and lending institutions. With fewer mediators and more attractive rates for both sides, it provides a special platform connecting private investors and borrowers.

Building a P2P lending business platform requires a comprehensive understanding of the industry, market demand, and regulatory requirements. It also requires robust technology infrastructure to ensure secure transactions, borrower and investor verification, and effective risk management.

This article will explore what is necessary to build a successful P2P lending platform, from defining the business model to launching and scaling the platform.

What Is a P2P Lending Platform?

A peer-to-peer (P2P) lending platform is an online marketplace connecting borrowers directly with investors, bypassing traditional financial intermediaries such as banks, credit brokers and other financial institutions.

Borrowers benefit from lower interest rates and more flexible loan terms, while investors earn higher returns than traditional investment options.

Traditional Banks VS Lending Platforms

| Criteria | Traditional Bank | P2P Platform |

| Intermediary | Acts as an intermediary between borrowers and lenders | Directly connects borrowers and lenders |

| Interest rates | Typically higher rates for borrowers and lower returns for investors | Generally lower rates for borrowers and higher returns for investors |

| Loan sizes | Often have higher minimum loan amounts | Lower minimum loan amounts, allowing for more flexibility |

| Speed of funding | It can take longer to approve and disburse loans | Faster approval and disbursement of loans |

| Risk assessment | Typically rely on credit scores and collateral | Use of alternative data sources and risk assessment models |

| Regulatory oversight | Heavily regulated by government authorities | Regulations vary by jurisdiction and may not be as stringent |

| Customer experience | Often less personalized and more bureaucratic | More personalized and user-friendly experience |

| Accessibility | It may have stricter eligibility requirements and limited accessibility | Generally more accessible and inclusive |

P2P Lending Platform Types & Models

There are currently four common business models in peer-to-peer lending:

-

Standard P2P lending;

-

P2P lending with a loan originator;

-

P2P lending bank-funded;

-

Balance-sheet lending.

In standard peer-to-peer lending, there is only one intermediary between you and the investor, the platform, which makes both the business model and the platform's incentive fairly easy to understand.

In P2P lending with lenders, there are two independent parties between you and the borrower (platform and lender), making it difficult for investors to understand the platform's incentive and who is borrowing on the platform.

The latter two business models are closer to shadow banking and whether or not they should be included among peer-to-peer loans is being debated.

P2P Lending Platform Key Features

Like other software, the functionality decides whether your product will interest users. It is, of course, besides the tech stack that will affect the quality of your platform.

Therefore, to interest the audience, remember the following features.

Borrowers Features

Loan Origination

A well-structured process where the borrower applies for a loan and the lender responds to the application is the key component of every peer-to-peer lending app and loan origination. You must provide the most convenient loan application.

Yet, given the extensive amount of information the borrower needs, developing and implementing such systems takes a lot of work.

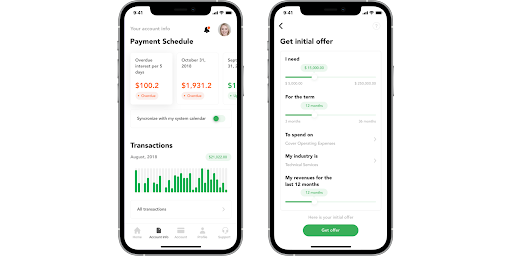

Loan Calculator

The borrowers calculate the loan payments and interest based on the term length and interest rate. Although there are various ways to calculate these components manually, most borrowers find it fairly challenging. You can include a loan calculator in your P2P lending app to simplify the procedure.

Pro Tip: Even if you add the calculator on the home screen, you must offer a separate page where users have multiple calculation options.

Credit Score Integration

Credit scores are numerical figures representing the creditworthiness of an individual based on their credit files. The credit score is what decides whether the individual is eligible for the loan or not. The user would either enter their credit score during the onboarding process or do it while applying for the loan, depending on your user experience strategy. The investor would assess the credit score and decide if they want to grant the loan.

Loan Application Matching

Your P2P lending app should also have an automatic loan application matching ability so that the borrowers’ applications can be automatically matched with the investors’ preferences. It would make your app more effective in terms of quickly finding the perfect borrower-investor matches.

Document Scanner

The borrowers will have to upload many documents and files to be eligible for a loan and to obtain the loan. Hence, adding a document scanner feature to your P2P lending app is convenient for them.

Auto-payment

The auto-payment feature allows borrowers to automate their loan repayments. With auto-payment, borrowers can authorize the platform to automatically deduct their monthly payments from their bank account or credit card, ensuring timely and consistent repayments.

This feature reduces the risk of missed payments and ensures a steady income stream for investors. Additionally, borrowers may be eligible for a lower interest rate if they opt for auto-payment, as it reduces the risk of default.

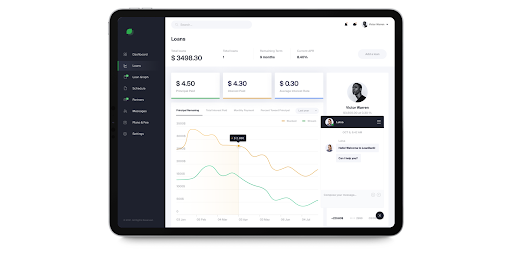

Dashboard

The dashboard allows borrowers to track the status of their loans and information such as their current outstanding balance, repayment schedule, and interest rate. Additionally, borrowers can use the dashboard to make payments, view transaction history, and communicate with the platform or investors.

The dashboard is an essential feature for p2p lending software that provides transparency and control to borrowers throughout the lending process.

Unlock the Future of Finance With Our P2P Lending Software Development Services

From robust technology infrastructure to user-friendly interfaces, we bring your P2P platform vision to life. Let's build success together!

Investors Features

Loan Portfolio Management

Loan portfolio management provides investors with a dashboard to track their investments, view loan details, and monitor loan performance. Additionally, investors can use the portfolio management feature to diversify their investments by spreading their money across multiple loans, reducing their risk exposure.

The loan portfolio management feature also allows investors to reinvest their returns automatically, increasing their potential earnings.

Loans Search

With this feature, investors can filter loans based on parameters such as loan amount, interest rate, credit score, and loan purpose. In addition, the loan search helps investors diversify their investment portfolio by allowing them to invest in multiple loans with varying risk levels and interest rates.

Semi-Automated Investment

Investors can set their investment criteria based on loan details, such as loan amount, interest rate, credit score, and loan purpose. This feature enables investors to save time and effort in the investment process while still maintaining control over their investment strategy.

P2P Admin Features

User Management

User management ensures the platform's security by controlling user access and maintaining user privacy. With user management, administrators can create, delete, and modify user accounts, assign roles and permissions, and monitor user activity.

This feature is very important since P2P lending systems handle sensitive personal and financial data.

Customer Relationship Management (CRM)

By implementing a CRM system, P2P lending platforms can gain insights into their customer base, streamline operations, and enhance the user experience.

Loan Management

Platform admins can customize loan terms, set interest rates, and manage borrower and lender data.

Finance Management

It is important to track all financial activities, such as loan disbursements, repayments, and service fees.

Platform Analytics

With customizable dashboards, all key metrics will be displayed on the main screen of the admin panel to monitor performance.

Synergy Between AI and P2P Lending Platforms

the intersection of Artificial Intelligence (AI) and Peer-to-Peer (P2P) lending platforms has emerged as a dynamic force reshaping traditional lending practices. This synergy brings forth a host of benefits, primarily centered around enhanced risk assessment and the automation of loan approval processes.

Enhanced Risk Assessment Through AI Algorithms

One of the pivotal advantages of integrating AI into P2P lending is the revolutionized approach to risk assessment. AI algorithms can analyze vast amounts of data with unparalleled speed and accuracy, providing a more nuanced understanding of an individual's creditworthiness. This translates to more precise risk evaluation, ultimately leading to better-informed lending decisions.

Automation of Loan Approval Processes

The integration of AI in P2P lending platforms has ushered in an era of streamlined loan approval processes. Automation, driven by sophisticated algorithms, expedites the assessment of loan applications. This reduces the time taken for approval and ensures a more efficient allocation of funds. Automating routine tasks frees up valuable human resources, allowing them to focus on more complex aspects of financial management.

Advantages of AI-Powered P2P Lending:

The advantages of AI-powered P2P lending are multifaceted, offering a transformative impact on the entire lending ecosystem.

- Improved Accuracy in Credit Scoring: AI's ability to analyze diverse data points results in a more comprehensive credit scoring system. This improved accuracy aids in better risk prediction, enabling lenders to make informed decisions. Borrowers with credible repayment capabilities are rightly identified, fostering a more secure lending environment.

- Reduction of Default Rates: By leveraging AI, P2P lending platforms can identify potential red flags indicative of a borrower's financial instability. This proactive approach significantly contributes to reducing default rates, safeguarding the interests of lenders and promoting financial sustainability.

- Increased Accessibility to Credit for Diverse Demographics: AI-driven credit assessments go beyond conventional metrics, opening up avenues for individuals with limited credit history. This inclusivity ensures that a broader spectrum of demographics, including those traditionally underserved by traditional banking, can access credit facilities.

- Streamlined Loan Application and Approval: The integration of AI not only enhances the accuracy of credit assessments but also expedites the entire loan application and approval process. Borrowers experience a more seamless and efficient journey, from application submission to fund disbursal.

- Quick Decision-Making: With AI algorithms swiftly processing vast amounts of data, decision-making becomes agile and responsive. This agility is particularly crucial when time sensitivity is paramount, providing borrowers with rapid feedback on their loan applications.

- Enhanced User Experience for Borrowers and Lenders: The infusion of AI not only benefits lenders but also enhances the overall experience for borrowers. The expedited processes, coupled with personalized interactions, contribute to a more user-friendly and customer-centric lending environment.

How to Start a Peer-to-Peer Lending Business

Typically, to start a peer-to-peer lending business, the regulator needs to provide the following documents:

- Information about the legal entity that will organize the P2P platform;

- Information about the board of directors, including their education, work experience and business reputation;

- Financial reports for the last three years;

- Business plan and organization structure;

- Business model, description of financial flows and assets;

- Description of internal anti-money laundering policies and procedures (AML/KYC policies).

This is a basic list of documents, which may vary depending on the requirements of the local regulator.

How To Build a P2P Lending Platform

We’ve already considered this topic in the other article on developing a custom fintech app. But let’s take a closer look at p2p lending platform development.

Step 1: Business Registration

When choosing a form of registration for a legal entity, you need to consider the following points:

- Registration as a corporation or limited liability company will protect against creditors in case of bankruptcy or force majeure.

- Corporations are subject to significantly more requirements than LLCs, including accounting and tax reporting requirements. In addition, corporations must hold shareholder meetings at regular intervals.

- Different forms of incorporation imply different tax statuses. However, an LLC can choose to pay taxes as an LLC or a corporation.

- The corporation must distribute profits and losses according to each member's share of ownership. In an LLC, the distribution takes place according to an operating agreement, the terms of which are determined by the company's participants.

Step 2: Register a Company Name

Usually, you must register a company (trademark) in the state where the business will operate. For P2P platforms, this is the location of the main office. At this stage, you need to consider the following points:

- The name must be free, which can be checked on the website of the US Patent and Trademark Office;

- The trademark name does not have to be the same as the domain name;

- Registration rules can vary significantly from state to state;

- It is desirable that by the company's name, people can understand the field of activity and the form of registration (this is mandatory). For example, "P2P Lending, Inc" if it's a corporation, or "P2P Lending, LLC" if it's a limited liability company.

Step 3: Register the Platform Domain

Domain is the address of your website. It should not be very long and easy to read. Abbreviations are welcome if the brand name is abbreviated. Important points at this stage are:

- The domain, like the company name, must be unique. You can check whether a domain is free or not on many sites that are easy to find using Google;

- Domain registration costs money. As a rule, these are small amounts - up to $20, but there may be exceptions depending on the domain zone - $100 or more;

- When you register a domain, you don't own it, you rent it.

Step 4:Team Building

This is the main factor in the success of any project, so the choice of a team must be approached with all seriousness. To do this, follow these recommendations:

- The staff needs to be staffed with people who know how to manage a website and experts in finance, financial law, marketing or advertising;

- In addition, we need people with banking experience who understand how to build a credit business and assess credit risks;

- You need to hire people with a long-term focus, immediately offering long-term contracts and social packages with accumulating bonuses.

It is better to hunt employees from other companies, preferably successful ones. Such people have the experience, the necessary skills and the understanding of the task. In addition, this way you at least a little, but shake competitors' position.

Step 5: Startup Capital

In addition to the maintenance of the site and other operating expenses, you will need money to issue the first loans at the start. You should not count on the fact that P2P investors will immediately come to your site. You can raise money in the following ways:

- Initial Coin Offering (ICO/STO). You can create tokens that will generate dividend income or reduce fees;

- Attracting venture capital. To do this, you need to draw up a detailed business plan and reach out to business angels - people who invest a lot of money in exchange for a share in the business;

- Bank loan. A solid deposit is required.

The amount of start-up capital depends on the cost of developing the platform, the size of the team, and the marketing strategy. The cost of creating a platform for P2P lending ranges from $20,000 to $100,000. If you use bounty campaigns, marketing promotion will take the same amount — a little less.

Step 6: Develop a P2P Platform

The platform can be created from scratch by hiring a team of blockchain programmers or by outsourcing development. However, it is better to use White Label solutions - ready-to-use products that can be customized. When using White Label, it is important to remember:

These are template solutions that are not suitable for unique loan products. You can integrate your lending scenarios into the White Label, requiring hiring the appropriate specialists.

Such products contain fewer errors and are more trusted by users. The development time of a P2P platform from scratch is from 8 to 16 months. With White Label, this time can be cut in half. The cost will also decrease.

Step 7: Create a Web Portal

When creating a high-load site for peer-to-peer lending, it is important to consider the following points:

- The portal should be integrated with the maximum number of payment gateways;

- The site interface should be intuitive and support several major languages;

- Some White Labels include basic website designs.

It should only be used as a draft. The design of your site should be unique and recognizable.

Step 8: Site and Platform Testing

Each custom use case for the platform needs to be tested to ensure everything works as it should. In this case, the most attention should be paid to:

- Security. The connection with the user and payment gateways must be encrypted, personal data is hidden behind seven seals, and financial gateways are closed with 1000 and 1 lock.

- Usability. The user, at the first transition to the site, must understand how to register, apply for a loan or invest money;

- performance. You can find out the speed of loading a site on different devices using the PageSpeed Insights service. There are also tools to improve the portal's performance.

Step 9: Launching the Platform

Before launching the site, you need to conduct a marketing campaign, offering the first users - borrowers and investors - discounts, lower (or higher for investors) interest rates, more loyal loan terms, and the like. But at the same time, you need to remember about:

- Fraudsters who want to get a loan and disappear. There are a lot of such people at the start, as it is possible to find loopholes in the risk assessment algorithm or user identification;

- Hackers who can launch phishing resources, try to hack a site or carry out a DoS attack (on order from competitors).

Step 10: Start Help Desk

Despite all the precautions, testing and debugging, the platform is almost guaranteed to contain errors and bugs after launch. And most likely, they will be detected not by regular specialists but by users. Therefore, it is important to quickly launch a support service that will work with maximum load in the first few months. Thanks to this, you will be able to:

- Catch and destroy most of the errors and bugs;

- Understand what was missed at the time of development and quickly add the missing features, elements, or instructions;

- Get feedback from users and understand what needs to be improved to make the platform more convenient and understandable.

How Much Does It Cost to Start a P2P Lending Platform

The total cost of developing a P2P money lending app depends on some factors, such as the overall complexity of the solution, the features required, the tech stack, the developers' hourly rate, the team's composition, etc.

On average, p2p lending platform development requires about 2200 development hours, starting from $100,000.

To launch a peer-to-peer lending website, you may require anything from six months to a year. However, if you adopt ready-made white-label solutions, the implementation period and development budget can be reduced by 2-3 times.

The ongoing maintenance cost includes expenses such as server hosting, security updates, and regulatory compliance, among others. This cost can vary depending on the size and complexity of the platform and can range from a few thousand to $10,000 per year.

How to Comply With Government Regulations

In the modern world, the volume of P2P lending amounts to tens of billions of dollars, and it grows every year. This is especially true for European and Asian P2P lending markets. What jurisdiction should be chosen to create a peer-to-peer platform?

Great Britain

P2P lending is regulated by the Financial Conduct Authority (FCA). The authorized capital is £ 50,000.

Terms, interest rates, marketing materials and information on the website must be completely transparent and not mislead the client. It is also necessary to clearly identify all the risks to the client. P2P platform investors can contact the financial ombudsman service to handle complaints. Borrowers are entitled to a cool-down period within 14 days of taking out a loan. They may refuse to pay the penalty/fee credit during this period.

Be aware of the exceptions: P2P platforms that operate on a tip or donation model do not require authorization from the FCA.

Lithuania

The Bank of Lithuania regulates P2P lending. The authorized capital is EUR 40,000. The Bank of Lithuania is considered one of the most progressive and loyal regulators in the FinTech sphere, so obtaining a license in Lithuania is much easier and faster. The term of receipt is one month.

In the future, it will be possible to resort to the possibility of passportization and, together with EMI or PSP licenses, work on the territory of other EU countries.

Estonia

Since March 2016, P2P lending platforms have been required to obtain a license from EFSA. Companies can obtain a license as a credit intermediary or lender. As an exception, companies that operate on a tip or donation model do not require licensing.

Finland

The Finnish Financial Supervisory Authority (FSA) regulates P2P lending. The authorized capital is EUR 50,000. Client funds must be handled jointly with a partner bank or payment system, or the company must obtain a payment system license.

Germany

In Germany, there is no legislation regarding P2P lending. However, activities related to the issuance of loans fall under the Banking Law. Consequently, market leaders and other platform operators work with partner banks as intermediaries.

Note that a similar regulatory regime is applied in France and Italy.

Portugal

The Portuguese Securities Market Commission (CMVM) regulates P2P lending, lending-based crowdfunding platforms, and investment-based crowdfunding platforms. The authorized capital is EUR 50,000.

Final Thoughts

When you decide to start peer-to-peer lending software development, there are many things to consider, from features that will help you stand out in the market to rules and regulations since you are dealing with other people’s finances. A trusted provider of lending software development services like Ardas will assist you in resolving all of these issues. Get in touch with us!